Consider the following macabre example conceived originally by Richard Zeckhauser. You are forced to play a game

Question:

Consider the following macabre example conceived originally by Richard Zeckhauser.

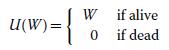

You are forced to play a “game” of Russian roulette, but before the game is played, you are allowed to pay to remove one bullet from the six-chamber gun. You have an initial wealth of $60 and each dollar gives you exactly 1 unit of utility if you are alive but no utility if you die (for the sake of this exercise, assume you have no heirs). In other words, your utility function is

a. Suppose the gun initially carries four bullets. You have the opportunity to reduce the number of bullets from four to three (and therefore, the probability of dying from 4/6 to 3/6) but it costs $30 to do so. What is your expected utility if you pay the $30? What is your expected utility if you elect not to pay?

b. According to expected utility theory, if it costs $30 to reduce the number of bullets from four to three, would you prefer to pay or take your chances with four bullets?

c. Still according to expected utility theory, what is the maximum you would be willing to pay to reduce the number of bullets from four to three? What is the maximum you would be willing to pay to reduce the number of bullets from one to zero (and thereby reduce the probability of dying from 1/6 to 0)?

d. Zeckhauser finds that most people report more willingness to pay to reduce the probability of dying from 1/6 to0 than to reduce it from 4/6 to 3/6 (Kahneman and Tversky 1979). Interpret this finding in light of what you have learned about prospect theory.

Step by Step Answer: