Hudson, Meehan, and Loiselle, a partnership, is considering admitting Thompson as a new partner. On July 31,

Question:

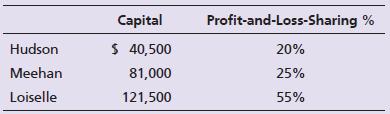

Hudson, Meehan, and Loiselle, a partnership, is considering admitting Thompson as a new partner. On July 31, 2024, the capital accounts of the three existing partners and their profit-and-loss-sharing ratio are as follows:

Requirements

Journalize the admission of Thompson as a partner on July 31 for each of the following independent situations:

1. Thompson pays Loiselle $162,000 cash to purchase Loiselle’s interest.

2. Thompson contributes $81,000 to the partnership, acquiring a 1/4 interest in the business.

3. Thompson contributes $81,000 to the partnership, acquiring a 1/6 interest in the business.

4. Thompson contributes $81,000 to the partnership, acquiring a 1/3 interest in the business.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison