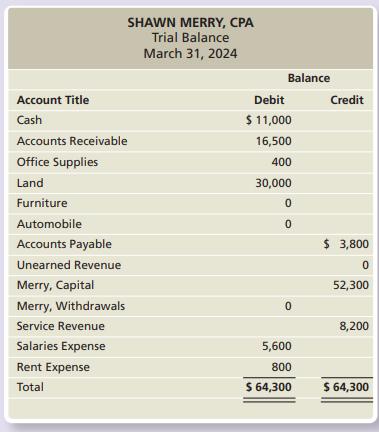

The trial balance of Shawn Merry, CPA, is dated March 31, 2024: During April, the business completed

Question:

The trial balance of Shawn Merry, CPA, is dated March 31, 2024:

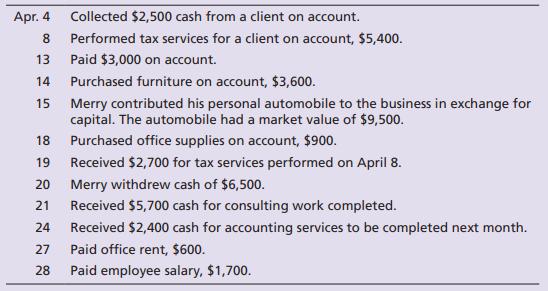

During April, the business completed the following transactions:

Requirements

1. Record the April transactions in the journal. Use the following accounts: Cash; Accounts Receivable; Office Supplies; Land; Furniture; Automobile; Accounts Payable; Unearned Revenue; Merry, Capital; Merry, Withdrawals; Service Revenue; Salaries Expense; and Rent Expense. Include an explanation for each entry.

2. Open the four-column ledger accounts listed in the trial balance, together with their balances as of March 31. Use the following account numbers: Cash, 11; Accounts Receivable, 12; Office Supplies, 13; Land, 14; Furniture, 15; Automobile, 16; Accounts Payable, 21; Unearned Revenue, 22; Merry, Capital, 31; Merry, Withdrawals, 33; Service Revenue, 41; Salaries Expense, 51; and Rent Expense, 52.

3. Post the journal entries to four-column accounts in the ledger, using dates, account numbers, journal references, and posting references. Assume the journal entries were recorded on page 5 of the journal.

4. Prepare the trial balance of Shawn Merry, CPA, at April 30, 2024.

Step by Step Answer:

Horngrens Accounting The Financial Chapters

ISBN: 9780136162186

13th Edition

Authors: Tracie Miller Nobles, Brenda Mattison