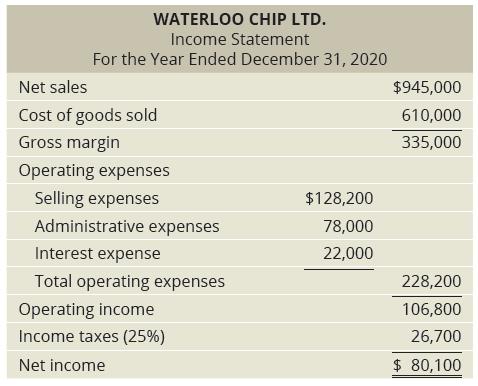

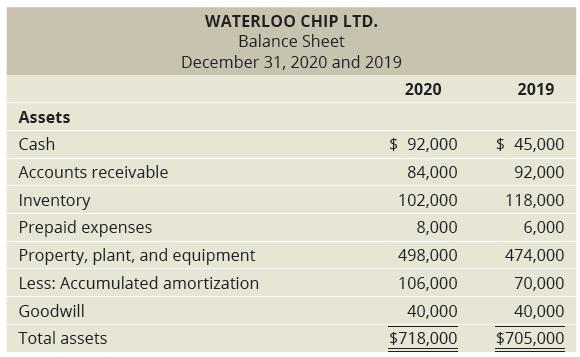

Waterloo Chip Ltd.s financial statements for the year ended December 31, 2020, are shown below: Required 1.

Question:

Waterloo Chip Ltd.’s financial statements for the year ended December 31, 2020, are shown below:

Required

1. Perform a horizontal analysis of the comparative balance sheets. Round all calculations to one decimal place. Comment on the analysis.

2. Perform a vertical analysis of the income statement. Round all calculations to one decimal place. The industry standards are gross margin of 35 percent and net income of 12 percent. Comment on the results.

3. Calculate each of the following ratios for the year ended December 31, 2020. Round answers to two decimal places. The industry standards are provided in parentheses for some of the ratios.

a. Current ratio (3.14)

b. Acid-test ratio

c. Inventory turnover

d. Days’ sales in inventory

e. Accounts receivable turnover

f. Days’ sales in receivables

g. Debt ratio (0.50)

h. Debt/equity ratio

i. Times-interest-earned ratio

j. Return on sales

k. Return on assets

l. Return on common shareholders’ equity

m. Price–earnings ratio—the market price per share is $30.00 at year-end, when dividends were paid (5.00)

n. Dividend yield (5.12%)

4. Comment on your calculations for Waterloo Chip Ltd. in Requirement 3. Include comments for those ratios for which industry standards were provided.

Step by Step Answer:

Horngrens Accounting

ISBN: 9780135359785

11th Canadian Edition Volume 2

Authors: Tracie Miller Nobles, Brenda Mattison, Ella Mae Matsumura, Carol A. Meissner, Jo Ann Johnston, Peter R. Norwood