Question: Discontinuing a product line, selling more product. The Northern Furniture Division of Grossman Corporation makes and sells tables and beds. The following revenue and cost

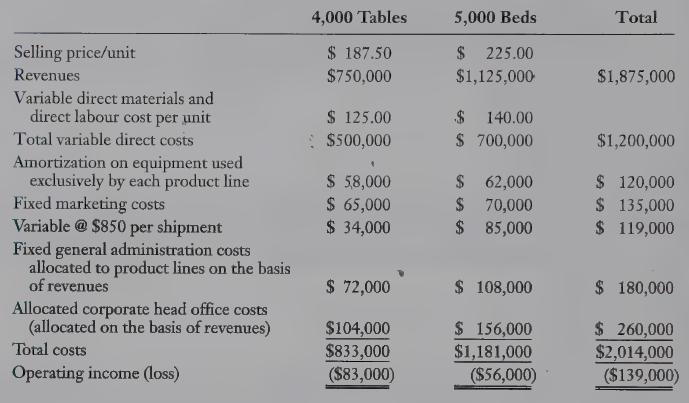

Discontinuing a product line, selling more product. The Northern Furniture Division of Grossman Corporation makes and sells tables and beds. The following revenue and cost information from the division's activity-based costing system is available:

a. On January 1, 2010, the equipment has a book value of $110,000 and zero disposal price. Any equipment not used remains idle.

b. Fixed marketing and distribution costs of a product line can be avoided if the line is and distribution savings, discontinued.

een

c. Fixed general administration costs of the division and corporate office costs will not change if sales of individual product lines are increased or decreased, or if product lines are added or dropped.

REQUIRED 1. Should the Furniture Division discontinue the tables product. line assuming the released facilities remain idle? Show all calculations.

2. Should the Furniture Division sell 4,000 more tables? Assume that to do so the division would have to acquire equipment costing $48,500 with a one-year useful life and zero terminal disposal value. Assume further that the fixed marketing and distribution costs will not change but that the number of shipments will double. Show all calculations.

LO1

4,000 Tables 5,000 Beds Total Selling price/unit Revenues Variable direct materials and direct labour cost per unit Total variable direct costs Amortization on equipment used exclusively by each product line Fixed marketing costs Variable @ $850 per shipment Fixed general administration costs $ 187.50 $750,000 $ 125.00 $ 225.00 $1,125,000 $1,875,000 : $500,000 $ 140.00 $ 700,000 $1,200,000 $ 58,000 $ 62,000 $ 120,000 $ 65,000 70,000 $ 135,000 $ 34,000 $ 85,000 $ 119,000 allocated to product lines on the basis of revenues Allocated corporate head office costs (allocated on the basis of revenues) Total costs Operating income (loss) $ 72,000 $ 108,000 $ 180,000 $104,000 $ 156,000 $ 260,000 $833,000 $1,181,000 ($83,000) ($56,000) $2,014,000 ($139,000)

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts