Ellas Bakery plans to purchase a new oven for its store.The oven has an estimated useful life

Question:

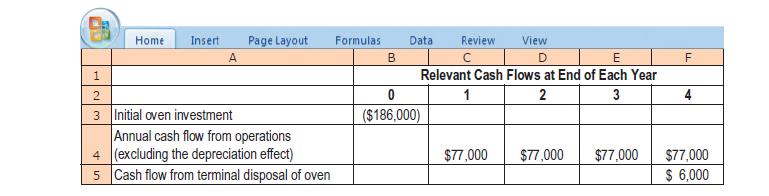

Ella’s Bakery plans to purchase a new oven for its store.The oven has an estimated useful life of 4 years. The estimated pretax cash flows for the oven are as shown in the table that follows, with no anticipated change in working capital. Ella’s Bakery has a 14% after-tax required rate of return and a 35% income tax rate. Assume depreciation is calculated on a straight-line basis for tax purposes using the initial investment in the oven and its estimated terminal disposal value. Assume all cash flows occur at year-end except for initial investment amounts.

1. Calculate

(a) net present value,

(b) payback period, and

(c) internal rate of return.

2. Calculate accrual accounting rate of return based on net initial investment.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9781292211541

16th Global Edition

Authors: Srikant Datar, Madhav Rajan