Margo London is the management accountant at Norse Credit. Norse Credit spends a lot of time and

Question:

Margo London is the management accountant at Norse Credit. Norse Credit spends a lot of time and resources trying to detect fraudulent activity within customers’ accounts. For most customers this is a low probability event. However, if it happens and Norse Credit does not detect it, it is very costly for the company.

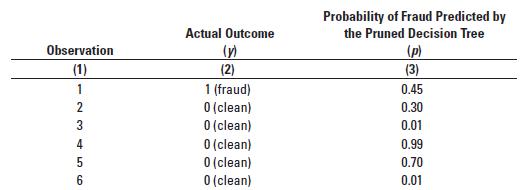

London is working with the data science team to improve models for predicting fraudulent activity in customers’ accounts. The table below lists six observations in a model’s validation sample and the probability of default predicted by the (pruned) decision tree.

Required

1. Calculate the likelihood value for each observation in the validation set as in Exhibit 11-14, column 8 using the following equation L = py X (1 - p)1 - y (remember x1 = x and x0 = 1).

2. Calculate the overall likelihood value for this set of predictions by multiplying the likelihood values for each observation together.

3. As the management accountant, would you use this model for decision making? Explain.

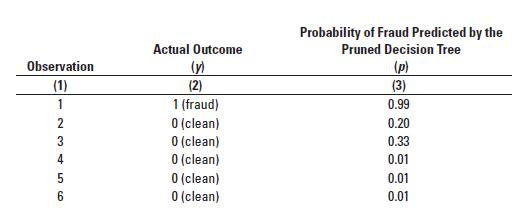

4. After becoming more familiar with the data, London’s team returns with a second model. The table below lists the six observations in the model’s validation sample and the probability of fraud predicted by the (pruned) decision tree. How does this model compare to the previous one? Should London be satisfied with the accuracy of the new model? Explain.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan