Oregon Outfitters, a manufacturer of fly fishing flies, uses a normal-costing system with a single overhead cost

Question:

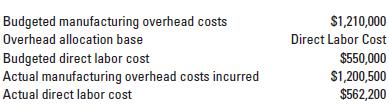

Oregon Outfitters, a manufacturer of fly fishing flies, uses a normal-costing system with a single overhead cost pool and direct labor cost as the cost-allocation base. The following data are for 2020:

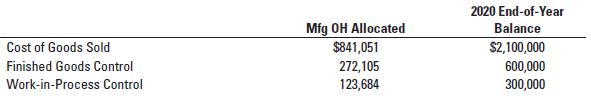

Manufacturing overhead allocated data and the ending balances (before proration of under- or overallocated overhead) in each account are as follows:

Required

1. Compute the budgeted manufacturing overhead rate for 2020.

2. Compute the under- or overallocated manufacturing overhead of Oregon Outfitters in 2020. Adjust for this amount using the following:

a. Write-off to Cost of Goods Sold

b. Proration based on ending balances (before proration) in Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold

c. Proration based on the overhead allocated in 2020 (before proration) in the ending balances of Work-in-Process Control, Finished Goods Control, and Cost of Goods Sold

3. Which method do you prefer in requirement 2? Explain.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan