Refer to the information in Problem 6-40. Assume the following: Animal Gear (AG) does not make any

Question:

Refer to the information in Problem 6-40. Assume the following: Animal Gear (AG) does not make any sales on credit. AG sells only to the public and accepts cash and credit cards; 90% of its sales are to customers using credit cards, for which AG gets the cash right away, less a 2% transaction fee.

Purchases of materials are on account. AG pays for half the purchases in the period of the purchase and the other half in the following period. At the end of March, AG owes suppliers $8,000.

AG plans to replace a machine in April at a net cash cost of $13,000. Labor, other manufacturing costs, and operating (nonmanufacturing) costs are paid in cash in the month incurred except of course depreciation, which is not a cash flow. Depreciation is $25,000 of the manufacturing cost and $10,000 of the operating (nonmanufacturing) cost for April.

AG currently has a $2,000 loan at an annual interest rate of 12%. The interest is paid at the end of each month. If AG has more than $7,000 cash at the end of April, it will pay back the loan. AG owes $5,000 in income taxes that need to be remitted in April. AG has cash of $5,900 on hand at the end of March.

Required

1. Prepare a cash budget for April for Animal Gear.

2. Why do Animal Gear’s managers prepare a cash budget in addition to the revenue, expenses, and operating income budget?

Data From Problem 6-40

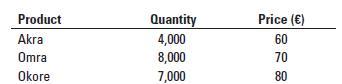

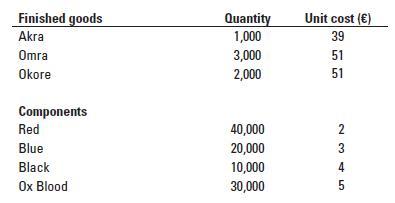

Akanson Crafts Ltd. is an arts gallery that produces three different arts products namely: Akra, Omra, and Okore. The budgeted sales of the products for 2020 were as follow:

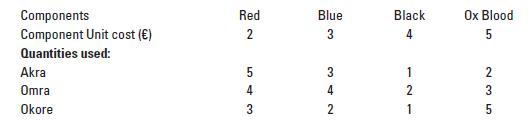

Materials used in the production of the products are:

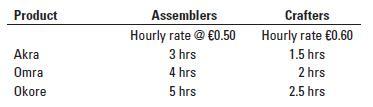

Two types of labor are used, Assemblers and Crafters, and the standard unit hours for each product are:

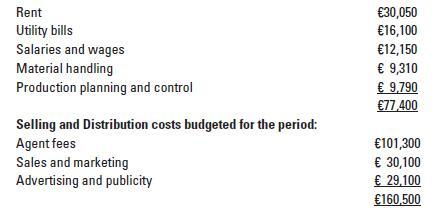

Production overhead which is absorbed into product costs on direct labor hour basis is budgeted as:

These are charged to the products in proportion to sales income of the period. Inventories at the beginning of the period are estimated as:

Ending inventories at the end of the period are estimated to increase by 10% and the beginning inventories as well as finished goods and component parts are estimated to reduce by 20%, respectively.

Step by Step Answer:

Horngrens Cost Accounting A Managerial Emphasis

ISBN: 9780135628478

17th Edition

Authors: Srikant M. Datar, Madhav V. Rajan