At December 31, 2019, the Cash account in the Tyler Companys general ledger had a debit balance

Question:

At December 31, 2019, the Cash account in the Tyler Company’s general ledger had a debit balance of \($18,434.27\). The December 31, 2019, bank statement showed a balance of \($19,726.40\). In reconciling the two amounts, you discover the following:

1. Bank deposits made by Tyler on December 31 amounting to \($2,145.40\) do not appear on the bank statement.

2. A non-interest-bearing note receivable from the Smith Company for \($2,000\), left with the bank for collection, was collected by the bank at the end of December. The bank credited the proceeds, less a \($5\) collection charge, on the bank statement. Tyler Company has not recorded the collection.

3. Accompanying the bank statement is a debit memorandum indicating that John Miller’s check for \($450\) was charged against Tyler’s bank account on December 30 because of insufficient funds.

4. Check No. 586, written for advertising expense of \($869.10\), was recorded as \($896.10\) by Tyler Company.

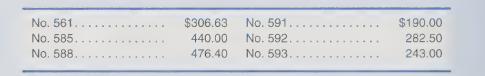

5. A comparison of the paid checks returned by the bank with the recorded disbursements revealed that the following checks are still outstanding as of December 31:

6. The bank mistakenly charged Tyler Company’s account for check printing costs of \($30.50\), which should have been charged to Taylor Company.

7. The bank charged Tyler Company’s account \($42.50\) for the rental of a safe deposit box. No entry has been made in Tyler’s records for this expense.

Required

a. Prepare a bank reconciliation as of December 31, 2019.

b. Prepare any necessary journal entries at December 31, 2019.

Step by Step Answer:

Financial & Managerial Accounting For Undergraduates

ISBN: 9781618533104

2nd Edition

Authors: Jason Wallace, James Nelson, Karen Christensen, Theodore Hobson, Scott L. Matthews