Question: We learned that merit pay increases may create a cost burden to employers because these increases carry over in base pay. Refer to Table 3-9,

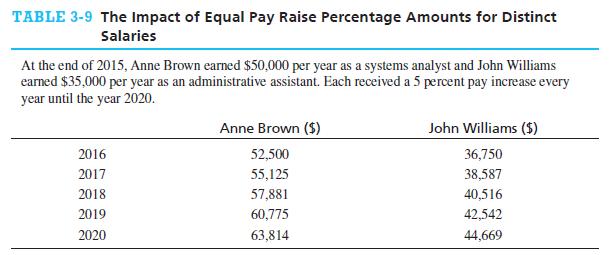

We learned that merit pay increases may create a cost burden to employers because these increases carry over in base pay. Refer to Table 3-9, in which Anne Brown’s annual salary is listed at the end of 2015 was $50,000 and John Williams’ was $35,000.

Questions:

1. Under a merit pay system, calculate Anne’s salary based on a 7 percent annual increase through the year 2020. For John, apply a 3 percent annual increase rate. What are their adjusted salaries for each year?

2. Let’s assume that both employees have reached the maximum pay rates for their jobs in 2015.

Under a longevity pay system, calculate the annual longevity payments for each employee through the year 2020. Using a 5 percent rate for each, what will the annual increases amount to?

What will their base pay rates be at the end of 2020?

3. Under a merit pay system scenario, let’s assume the goal is to provide Anne and John with the same annual pay increases as measured in dollars, just for 2016. It’s been determined that Anne’s annual increase rate will be 5 percent. What should the rate be for John? After applying the increase amounts, what will Anne’s and John’s new salaries be at the end of 2016?

TABLE 3-9 The Impact of Equal Pay Raise Percentage Amounts for Distinct Salaries At the end of 2015, Anne Brown earned $50,000 per year as a systems analyst and John Williams earned $35,000 per year as an administrative assistant. Each received a 5 percent pay increase every year until the year 2020. 2016 2017 2018 2019 2020 Anne Brown ($) 52,500 55,125 57,881 60,775 63,814 John Williams ($) 36,750 38,587 40,516 42,542 44,669

Step by Step Solution

There are 3 Steps involved in it

1 Merit Pay System Year Annes Salary Johns Salary 2015 50000 35000 2016 52500 50000 107 36050 35000 ... View full answer

Get step-by-step solutions from verified subject matter experts