Question: Refer to the information provided in P113B for Software Associates. Required: Prepare the operating activities section of the statement of cash flows for Software Associates

Refer to the information provided in P11–3B for Software Associates.

Required:

Prepare the operating activities section of the statement of cash flows for Software Associates using the direct method.

P11–3B

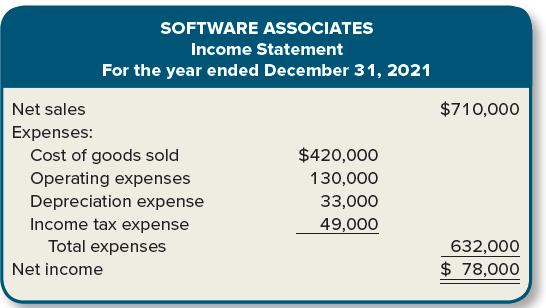

Portions of the financial statements for Software Associates are provided below.

SOFTWARE ASSOCIATES

Selected Balance Sheet Data

December 31, 2021, compared to December 31, 2020

Decrease in accounts receivable ..................... $10,000

Decrease in inventory ............................................ 13,000

Increase in prepaid rent .......................................... 3,000

Decrease in salaries payable ................................. 4,000

Increase in accounts payable ............................... 7,000

Increase in income tax payable ........................... 8,000

SOFTWARE ASSOCIATES Income Statement For the year ended December 31, 2021 Net sales $710,000 Expenses: Cost of goods sold $420,000 Operating expenses Depreciation expense 130,000 33,000 Income tax expense 49,000 Total expenses 632,000 $ 78,000 Net income

Step by Step Solution

3.36 Rating (171 Votes )

There are 3 Steps involved in it

Operating Activities Net income 78000 Adjustments to reconcile net income to net ... View full answer

Get step-by-step solutions from verified subject matter experts