The following information is available for the Albert and Allison Gaytor family in addition to that provided

Question:

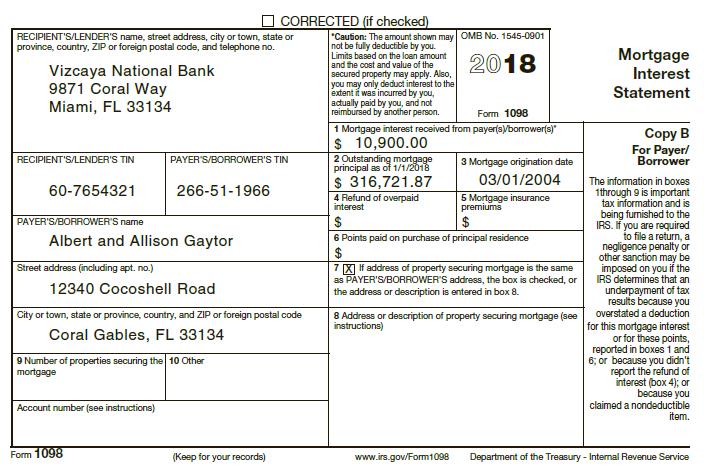

The following information is available for the Albert and Allison Gaytor family in addition to that provided in Chapters 1– 4. Albert and Allison received the following form:

Albert and Allison paid the following in 2018 (all by check or can otherwise be substantiated):

Contributions to Perpetual Perpetuity Catholic Church ...................................... $ 510

Tuition to Perpetual Perpetuity Catholic School for Crocker ............................. 6,000

Clothes to Salvation Army (10 bags in good condition) ........................................ 275

Contributions to George Kerry’s Congressional campaign ................................... 250

Psychotherapy for Allison ................................................................................................ 2,210

Prescription eyeglasses for Crocker ................................................................................ 364

Prescription medication and drugs ............................................................................. 1,850

Credit card interest ............................................................................................................ 1,345

Interest on Albert’s college loans ................................................................................. 3,125

Actual state sales tax (including sales tax on new auto of $2,000) ................. 3,102

Investment interest expense on stock margin account .......................................... 345

Auto loan interest reported on Form 1098 (not shown here; ............................. 860

auto was paid for by a home equity loan on residence)

Auto insurance ................................................................................................................... 1,600

Cosmetic surgery for Albert ........................................................................................... 4,500

Dave Deduction, CPA, for preparation of last year’s tax return .......................... 765

Safe-deposit box for storage of stocks and tax data .............................................. 100

Contribution to an educational savings account for Crocker ........................... 1,000

Home property taxes ....................................................................................................... 4,600

Unreimbursed business expense (seminar on dealing with ................................. 700

hijacking at sea)

In August 2018, Crocker was on an out-of-town field trip with the university band and his appendix burst. He required immediate surgery which was considered “out of network” for the Gaytor’s health plan resulting in hospital and doctor’s fees of $3,000 not covered by insurance. In addition, Allison drove 300 miles round trip to be with Crocker after the surgery and drive him home after he recovered. She spent two nights in a hotel at a cost of $140 per night.

In June, Albert purchased a new professional digital SLR camera for $7,950. While the Gaytors were on vacation in August, someone broke into their residence and stole the camera. Albert’s homeowners’ insurance did not reimburse him for any part of the loss since he declined the special premium add-on for high value items required by his policy.

For the 2018 tax year, on April 15, 2019, Albert contributes $5,500 to a traditional IRA for himself and $5,500 to a traditional IRA for his wife. He is not covered by a qualified retirement plan at work.

Albert managed to gather his gambling loss documentation and can substantiate gambling losses of $3,480 in 2018 (refer back to Chapter 2 for gambling winnings).

Required:

Combine this new information about the Gaytor family with the information from Chapters 1–4 and complete a revised 2018 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded with more tax information in later chapters.

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill