Question: A. Bea Jones (birthdate March 27, 1984) moved from Texas to Florida in December 2017. She lives at 654 Ocean Way, Gulfport, FL 33707. Beas

A. Bea Jones (birthdate March 27, 1984) moved from Texas to Florida in December 2017. She lives at 654 Ocean Way, Gulfport, FL 33707. Bea’s Social Security number is 466-78-7359 and she is single. Her earnings and income tax withholding for 2018 for her job as a manager at a Florida shrimp-processing plant are:

Earnings from the Gulf Shrimp Co..............$43,200

Federal income tax withheld.............4,600

State income tax withheld..............0

Bea’s other income includes interest on a savings account at Beach National Bank of $2,200 and $600 per month alimony from her ex-husband in accordance with their 2010 divorce decree.

Bea’s employer operates a 401(k) plan, and although she is eligible, Bea does not participate. During 2018, Bea paid the following amounts (all of which can be substantiated):

Home mortgage interest................$8,700

Auto loan interest................2,300

State sales tax................820

Property taxes on personal residence................3,233 Unreimbursed hospital bills................3,250

Doctor bills................2,612

Other deductible medical expenses................720

Income tax preparation fee................600

Job-hunting expenses................925

Contribution to IRA................2,500

In September 2018, Tropical Storm Yuri struck Gulfport and a tree fell on Bea’s home. Bea acquired the home in February 2011 for $110,000. The estimated loss in market value from damage was equal to her repair charge of $7,800. The damage caused by TS Yuri was declared a federal disaster (code EM-1212). Bea’s deductible was quite high and her insurance company only reimbursed her $1,200.

Required:

Complete Bea’s federal tax return for 2018. Use Form 1040, Schedule A, Schedule B, and Form 4684 (if needed) to complete this tax return. Make realistic assumptions about any missing data.

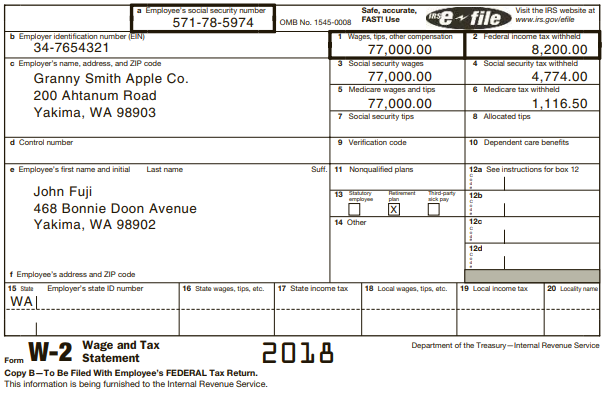

B. John Fuji (birthdate June 6, 1980) moved from California to Washington in December 2017. His earnings and income tax withholding for 2018 for his job as a manager at a Washington apple-processing plant are:

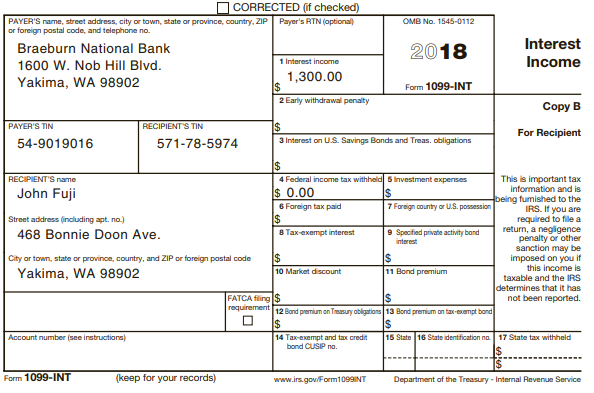

John’s other income includes interest on a Certificate of Deposit reported on a Form 1099-INT:

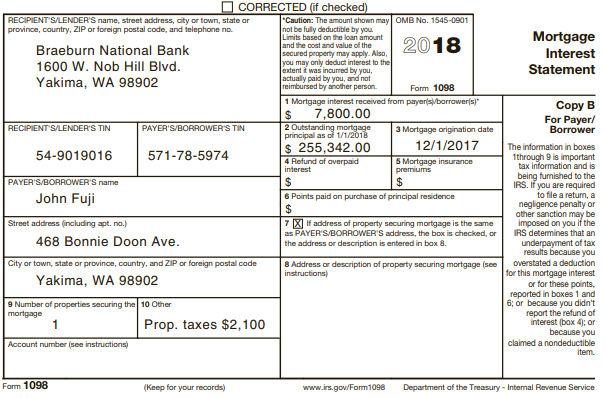

Also, in accordance with the 2012 divorce decree he paid $500 per month alimony to his ex-wife (Dora Fuji, Social Security number 573-79-6075). John received the following Form 1098 reporting mortgage interest and property taxes:

During 2018, John paid the following amounts (all of which can be substantiated):

Auto loan interest................1,575

Credit card interest................655

State sales tax................1,285

Assisted living charges for Gala................5,250

Doctor bills................2,550

Other deductible medical expenses................760

Income tax preparation fee................500

Job-hunting expenses................925

Cash charitable donation to the Jonagold Research Center ................400

John’s employer offers a retirement plan, but John does not participate. Instead, he made a $4,000 contribution to a Roth IRA. John also provides 100 percent of the support for his mother, Gala Fuji (Social Security number 323-11-4455). Gala is chronically ill and lives in an assisted living facility in Yakima. Her only income is interest of about $400 on a modest savings account.

Required:

Complete John’s federal tax return for 2018. Use Form 1040, Schedule 1, and Schedule A to complete this tax return. Make realistic assumptions about any missing data.

a Employee's social security number 571-78-5974 Safe, accurate, FASTI Use Visit the IRS website at www.irs.govlefile RS file OMB No. 1545-0008 b Employer identification number (EN) 34-7654321 Federal income tax withheld Wages, tips, other compensation 8,200.00 4 Social security tax withheld 77,000.00 3 Social security wages a Employer's name, address, and ZIP code 77,000.00 5 Medicare wages and tips 4,774.00 6 Medicare tax withheld Granny Smith Apple Co. 200 Ahtanum Road 1,116.50 77,000.00 7 Social security tips Yakima, WA 98903 8 Allocated tips 9 Verification code d Control number 10 Dependent care benefits e Employee's fist name and initial Suff. 11 Nonqualified plans Last name 12a See instructions for bax 12 John Fuji 13 tay mplye -paty ick pay 12b plan 468 Bonnie Doon Avenue 120 Yakima, WA 98902 14 Other 12d f Employee's address and ZIP code 19 Local income tax 20 Locality name 15 State Employer's state ID number 16 State wages, tips, eta. 17 State income tax 18 Local wages, tips, etc. WA Wage and Tax Statement W-2 2018 Department of the Treasury-Internal Revenue Service Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service. CORRECTED (if checked) PAYER'S name, street address, city or town, state or province, country, ZIP or foreign postal code, and telephone no. Payer's RTN (optional) OMB No. 1545-0112 Braeburn National Bank 2018 Interest 1 Interest income Income 1600 W. Nob Hill Blvd. Yakima, WA 98902 1,300.00 2$ 2 Early withdrawal penalty Form 1099-INT Copy B PAYER'S TIN RECIPIENT'S TIN 2$ For Recipient 54-9019016 571-78-5974 3 Interest on U.S. Savings Bonds and Treas. obligations 2$ 4 Federal income tax withheld 5 Investment expenses s 0.00 6 Fareign tax paid RECIPIENT'S name This is important tax information and is being fumished to the IRS. If you are required to file a return, a negligence penalty or other sanction may be imposed on you if John Fuji 7 Freign country or U.S. possession Street address (including apt. no.) 468 Bonnie Doon Ave. 8 Tax-exempt interest 9 Specified private activity band interest City or town, state or province, country, and ZIP or foreign postal code I2$ Yakima, WA 98902 10 Market discount 11 Bond premium this income is taxable and the IRS determines that it has not been reported. I2$ FATCA filing $ requirement 12 Bond premium on Treasury obligations 13 Bond premium on tax-eempt bond 2$ IS 15 State 16 State identification na 17 State tax withheld Account number (see instructions) 14 Tax-exempt and tax credit bond CUSIP no. Form 1099-INT (keep for your records) www.irs.gov/Form1099INT Department oaf the Treasury - Internal Revenue Service

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

A B 1040 Filing status X Single Your first name and initial Bea Your standard deduction If joint retum spouses first name and initial Department of th... View full answer

Get step-by-step solutions from verified subject matter experts