A. Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number

Question:

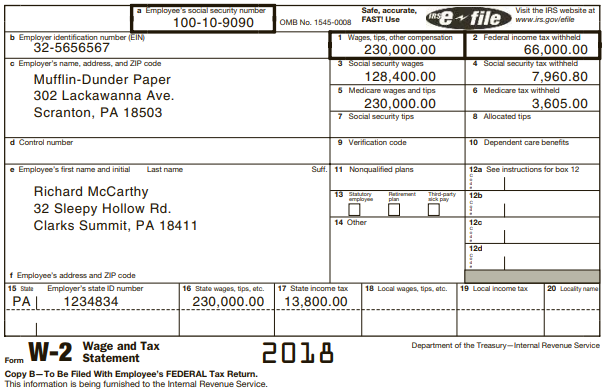

A. Richard McCarthy (born 2/14/64; Social Security number 100-10-9090) and Christine McCarthy (born 6/1/1966; Social security number 101-21-3434) have a 19-year-old son (born 10/2/99 Social Security number 555-55-1212), Jack who is a full-time student at the University of Key West. The McCarthys also have a 12-year-old daughter (Social Security number 444-23-1212), Justine, that lives with them. Richard is the CEO at a national paper company. His 2018 Form W-2:

Christine is an optometrist and operates her own practice (“The Eyes of March”) in town as a sole proprietor. The shop address is 1030 Morgan Highway, Clarks Summit, PA 18411 and the business code is 621320. Christine keeps her books on the accrual basis and her bookkeeper provided the following information:

Gross sales.....................$270,000

Returns.....................9,000

Inventory:

Beginning inventory.....................$24,000

Purchases.....................120,000

Ending inventory 30,000

Rent.....................24,000

Insurance.....................11,000

Professional fees.....................3,000

Payroll.....................37,000

Payroll taxes.....................2,800

Utilities.....................4,000

Office expenses.....................2,000

Depreciation.....................5,000

The McCarthys have a nanny/housekeeper they paid $12,000 during 2018. They did not withhold income or FICA taxes. The McCarthys paid Pennsylvania state unemployment tax of $378 in 2018. Christine received a 2018 Form 1099-INT from the National Bank of Scranton that listed interest income of $23,400. Note that McCarthys reasonably allocate $1,278 to state income tax expense for purposes of the Net Investment Income tax. The McCarthys paid the following in 2018:

Home mortgage interest.............$15,600

Property taxes.............5,600

Estimated state income tax payments.............3,000

Estimated Federal income tax payments.............11,000

Charitable contributions (all cash)..............7,600

Required:

Complete the McCarthys’ federal tax return for 2018. Use Form 1040, Schedule 1, Schedule 4, Schedule A, Schedule B, Schedule C, Schedule H, Schedule SE, Form 8959, and Form 8960 to complete this tax return. Make realistic assumptions about any missing data and ignore any alternative minimum tax. Do not complete Form 4952, which is used for depreciation.

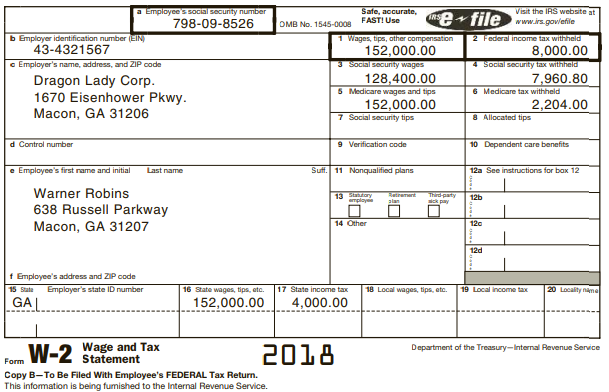

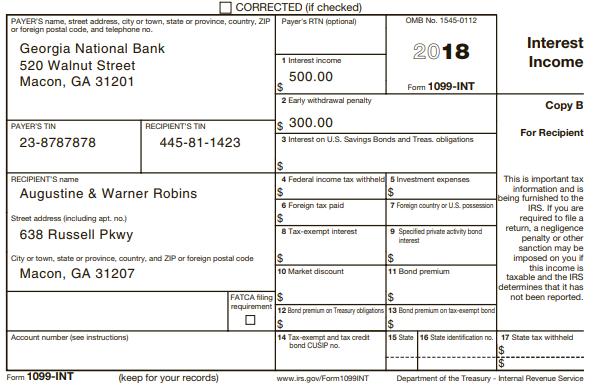

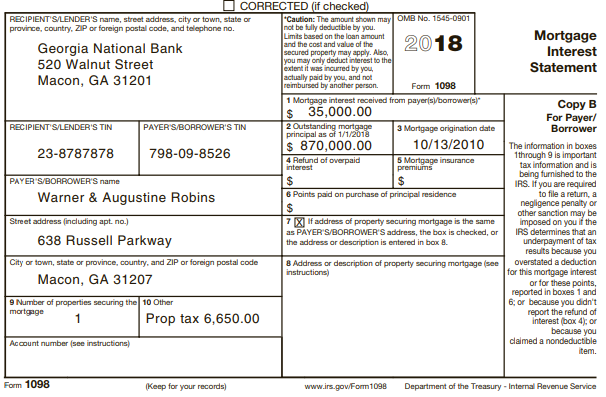

B. Warner and Augustine Robins, both 33 years old, have been married for 9 years and have no dependents. Warner is the president of Dragon Lady Corporation located in Macon. The Dragon Lady stock is owned 40 percent by Warner, 40 percent by Augustine, and 20 percent by Warner’s father. Warner and Augustine received the following tax documents:

Macon Museum of Arts

3231 Vineville Ave.

Macon, GA 31204

Employer Identification Number 22-1234567

Macon Museum of Arts is a registered 501(c)(3) corporation

November 23, 2018

Mr. and Mrs. Warner and Augustine Robins

628 Russell Parkway

Macon, GA 31207

Dear Mr. and Mrs. Robins:

Thank you for your contribution of the original album cover art for the Almond Sisters Band to the Macon Museum of Arts. This gift supports the Macon Museum’s efforts to bring original and locally-sourced art work to Macon. This continuing support will guarantee our ability to display Almond Sister art work for many years to come. We have attached a copy of the appraiser’s market valuation. Her analysis estimates the value of the painting at $34,505. Please keep this written acknowledgement of your donation for your tax records. As a token of our appreciation for your support, we have mailed you the Macon Museum tote bag. We estimate the value of the tote bag to be $5. We are required to inform you that your federal income tax deduction for your contribution is the amount of your contribution less the value of the tote bag. Thank you for your continuing support for our important work in this field! Please retain this letter as proof of your charitable contribution. Thank you for helping us to help veterans. Sincerely,

Jack T. Mann

Art Development Officer

The Robins paid the following amounts (all can be substantiated):

General state sales tax...............2,120

Auto loan interest...............4,800

Medical insurance...............10,400

Income tax preparation fee...............750

Charitable contributions in cash:

Church...............2,600

Tree Huggers Foundation (a qualified charity)...............3,000

Central Georgia Technical University...............5,000

Safe-deposit box...............300

The tax basis for the donated painting is $25,000 and the painting has been owned by Warner and Augustine for 5 years. Dragon Lady does not cover health insurance for its employees. In addition to Warner and Augustine’s health insurance premiums shown above, Augustine required surgery which cost $6,720 for which only $3,100 was covered by insurance. Warner had to drive Augustine 300 miles each way to a surgical center. On January 1, 2018, Warner sold land to Dragon Lady Corporation for $75,000. He acquired the land 5 years ago for $160,000. No Form 1099-B was filed for this transaction. Dragon Lady Corporation does not have a qualified pension plan or Section 401(k) plan for its employees. Therefore, Warner deposited $11,000 ($5,500 each) into traditional IRA accounts for Augustine and himself (neither are covered by a qualified plan at work).

Required:

Complete the Robins’ federal tax return for 2018. Use Form 1040, Schedule 1, Schedule A, Schedule D, and Form 8949 to complete this tax return. Make realistic assumptions about any missing data and ignore any alternative minimum tax. Do not complete Form 8283, which is used when large noncash donations are made to charity.

Ending InventoryThe ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill