Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guildas

Question:

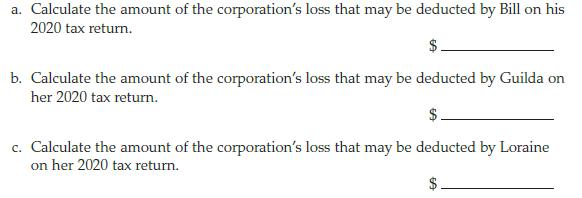

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda’s basis in her stock is $21,000. On May 26, 2020, Bill sells his stock, with a basis of $40,000, to Loraine for $50,000. For the 2020 tax year, Radiata Corporation has a loss of $104,000.

Transcribed Image Text:

a. Calculate the amount of the corporation's loss that may be deducted by Bill on his 2020 tax return. b. Calculate the amount of the corporation's loss that may be deducted by Guilda on her 2020 tax return. c. Calculate the amount of the corporation's loss that may be deducted by Loraine on her 2020 tax return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

a 20800 104000 x 50 x 146365 Leap year 208852...View the full answer

Answered By

Shameen Tahir

The following are details of my Areas of Effectiveness. The following are details of my Areas of Effectiveness English Language Proficiency, Organization Behavior , consumer Behavior and Marketing, Communication, Applied Statistics, Research Methods , Cognitive & Affective Processes, Cognitive & Affective Processes, Data Analysis in Research, Human Resources Management ,Research Project,

Social Psychology, Personality Psychology, Introduction to Applied Areas of Psychology,

Behavioral Neurosdence , Historical and Contemporary Issues in Psychology, Measurement in Psychology, experimental Psychology,

Business Ethics Business Ethics An introduction to business studies Organization & Management Legal Environment of Business Information Systems in Organizations Operations Management Global Business Policies Industrial Organization Business Strategy Information Management and Technology Company Structure and Organizational Management Accounting & Auditing Financial Accounting Managerial Accounting Accounting for strategy implementation Financial accounting Introduction to bookkeeping and accounting Marketing Marketing Management Professional Development Strategies Business Communications Business planning Commerce & Technology Human resource management General Management Conflict management Leadership Organizational Leadership Supply Chain Management Law Corporate Strategy Creative Writing Analytical Reading & Writing Other Expertise Risk Management Entrepreneurship Management science Organizational behavior Project management Financial Analysis, Research & Companies Valuation And any kind of Excel Queries.

4.70+

16+ Reviews

34+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda's basis in her stock is $25,000. On July 31, 2013, Bill sells his stock, with a basis of $40,000, to...

-

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guilda's basis in her stock is $25,000. On July 31, 2012, Bill sells his stock, with a basis of $40,000, to...

-

Bill and Guilda each own 50 percent of the stock of Radiata Corporation, an S corporation. Guildas basis in her stock is $25,000. On July 31, 2014, Bill sells his stock, with a basis of $40,000, to...

-

The common stock of Fido Corporation was trading at $45 per share on October 15, 2010. A year later, on October 15, 2011, it was trading at $80 per share. On this date, Fidos board of directors...

-

Clarice, a young woman with a mental disability, brought a malpractice suit against a doctor at the Medical Center. As a result, the Medical Center refused to treat her on a nonemergency basis....

-

A company that is uncertain about the exact date when it will pay or receive a foreign currency may try to negotiate with its bank a forward contract that specifies a period during which delivery can...

-

Suppose that \(x_{i}\) only takes on the values 0 and 1. Out of the \(n\) observations, \(n_{1}\) take on the value \(x=0\). The \(n_{1}\) observations have an average \(y\) value of \(\bar{y}_{1}\)....

-

Majoli Inc. has capitalized computer software costs of $3,900,000 on its new Trenton software package. Revenues from 2012 (first year) sales are $2,000,000. Additional future revenues from Trenton...

-

Custom Furniture Company Contribution Income Statement For the Month of June Total Per Unit Sales (500 chairs) $ 250,000 $ 500 Less: Variable expenses 150,000 300 Contribution margin 100,000 $ 200...

-

Cedar Corporation has an S corporation election in effect. During the 2020 calendar tax year, the corporation had ordinary taxable income of $200,000, and on January 15, 2020, the corporation paid...

-

Which of the following statements is false regarding corporate tax return due dates? a. Corporate tax returns for 2020 calendar-year corporations are due April 15, 2021. b. Corporate tax returns may...

-

The Transmission Shop was the largest company in the state specializing in rebuilding automobile transmissions. Every transmission rebuilt by the business was covered by a six-month warranty. The...

-

Your company sells digital advertising displays in shopping centers. Shopping center and mall advertising is especially helpful for the shops at these venues as the digital panels direct shoppers to...

-

Read the Selling in Action feature titled Pricing Professional FeesCreating a Value Proposition. What should a professional person consider when determining appropriate fees for their service and...

-

Describe the following methods used to estimate the cost of individual services: a. Cost-to-charge ratio (CCR) method b. Relative value unit (RVU) method c. Activity-based costing (ABC) method

-

You have taken over a number of accounts of another salesperson, Lee Bizon. Most of these accounts are prospects, which means that they have not yet purchased from NewNet. Two accounts did purchase...

-

a. What is target costing? b. Suppose a hospital was offered a capitation rate for a covered population of $40 per member per month (PMPM). Briefly explain how target costing would be applied in this...

-

Monet, Inc., is authorized to issue 1,500,000 shares of no- par common stock and 800,000 shares of $ 40 par value 6 percent preferred stock. During its first year of operation, the company plans to...

-

For the following exercises, write the first four terms of the sequence. a n = 2 n 2

-

Ulmus Corporation is an engineering consulting firm and has $1,120,000 in taxable income for 2019. Calculate the corporations income tax liability for 2019.

-

For its current tax year, Ilex Corporation has ordinary income of $260,000, a short-term capital loss of $60,000, and a long-term capital gain of $20,000. Calculate Ilex Corporations tax liability...

-

Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of $160,000 for 2019. The corporation also has $30,000 in dividends from publicly traded domestic...

-

How can leaders sustain momentum and relevance around visionary visions amidst evolving external environments, internal dynamics, and competing priorities, fostering adaptability, resilience, and...

-

What cognitive processes underlie the formulation of visionary narratives, and how can leaders leverage storytelling techniques to evoke emotional resonance, foster buy-in, and drive transformative...

-

Let U = {1, 2, 3, 4, 5, 6, 7, 8, 9, 10}, A = {1, 3, 5, 7, 9}, B = {2, 4, 6, 8, 10}, and C = {1, 2, 4, 5, 8, 9}. List the elements of each set. (a) CC c (b) ( A C ) c (c) A ( B C )

Study smarter with the SolutionInn App