Brian and Kim have a 12-year-old child, Stan. For 2020, Brian and Kim have taxable income of

Question:

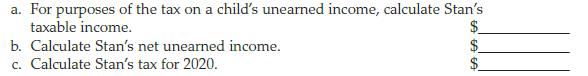

Brian and Kim have a 12-year-old child, Stan. For 2020, Brian and Kim have taxable income of $52,000, and Stan has interest income of $4,500. No election is made to include Stan’s income on Brian and Kim’s return.

Transcribed Image Text:

a. For purposes of the tax on a child's unearned income, calculate Stan's taxable income. b. Calculate Stan's net unearned income. c. Calculate Stan's tax for 2020. $ $ EA GA

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

a 3400 4500 1...View the full answer

Answered By

Shehar bano

I have collective experience of more than 7 years in education. my area of specialization includes economics, business, marketing and accounting. During my study period I remained engaged with a business school as a visiting faculty member and did a lot of business research. I am also tutoring and mentoring number of international students and professionals online for the last 7 years.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Brian and Kim have a 12-year-old child, Stan. For 2014, Brian and Kim have taxable income of $52,000, and Stan has non-qualifying dividend income of $4,500 and investment expenses of $250. No...

-

Brian and Kim have a 12-year-old child, Stan. For 2013, Brian and Kim have taxable income of $52,000, and Stan has non-qualifying dividend income of $4,500 and investment expenses of $250. No...

-

Brian and Kim have a 12-year-old child, Stan. For 2012, Brian and Kim have taxable income of $52,000, and Stan has nonqualifying dividend income of $4,500 and investment expenses of $250. No election...

-

Since the introduction of enhanced security measures by the U.S. Department of Homeland Security in 2017, flights bound for the U.S. from Canada are subject to additional screening by airline...

-

Daily revenue from vending machines placed in various buildings of a major university is as follows: 20, 75, 43, 62, 51, 52, 78, 33, 28, 39, 61, 56, 43, 49, 48, 49, 71, 53, 57, 46, 42, 41, 63, 36,...

-

Henry, who earned $84,420 during 2014, is paid on a monthly basis, is married, and claims four allowances. a. What is Henrys federal tax withholding for each pay period? b. What is Henrys FICA...

-

Suppose that \(v_{1}, v_{2}, \ldots, v_{n}\) are positive numbers. The arithmetic mean and the geometric mean of these numbers are, respectively, (a) It is always true that \(v_{A} \geq v_{G}\)....

-

Action, Inc., had the following sales and purchase transactions during 2013. Beginning inventory consisted of 120 items at $80 each. Action uses the FIFO cost flow assumption and keeps perpetual...

-

2. Draw logic diagrams for the following: a) Y = (A+B) + (B C) b) Y = (A+B) (A + C) c) Y = (A + B). C

-

B Corporation, a calendar year-end, accrual basis taxpayer, is owned 75 percent by Bonnie, a cash basis taxpayer. On December 31, 2020, the corporation accrues interest of $4,000 on a loan from...

-

Pekoe sold stock to his sister Rose for $12,000, its fair market value. Pekoe bought the stock 5 years ago for $16,000. Also, Pekoe sold Earl (an unrelated party) stock for $6,500 that he bought 3...

-

A beam of light consists of two wavelengths, 590.159 nm and 590.220nm, that are to be resolved with a diffraction grating. If the grating has lines across a width of 3.80cm, what is the minimum...

-

Many analysts argue that football clubs are special cases and you cannot blindly apply standard Z-score models to the industry. Critically assess this argument and discuss why you think it may or may...

-

The registered name for a product. a. goodwill b. trade na me c. trade s ecret d. brand na me e. trademark

-

What are some situations other than immediate financial distress that lead firms to file for bankruptcy?

-

What happened to the pre-bankruptcy stockholders and the claims of creditors?

-

What is the annual report, and what two types of information does it present?

-

Johnston Industries uses the perpetual inventory system for some of its products. From the following information, prepare the journal entries to record the cost of goods sold under FIFO and LIFO....

-

If 2 5 9 - k 5 8 = 2 5 8 , what is the value of k?

-

If a taxpayers 2016 individual income tax return was filed on March 3, 2017, the statute of limitations would normally run out on: a. April 15, 2019 b. March 3, 2016 c. April 15, 2020 d. March 3,...

-

Which of the following deductions has a 6-year statute of limitations? a. Depreciation b. Salaries c. Travel and entertainment d. A return in which the taxpayer omitted gross income in excess of 25...

-

Which of the following tax preparers may not represent their clients in all IRS proceedings? a. An enrolled agent b. A certified public accountant c. An attorney d. All of the above may represent...

-

Explain the competitive factors of the companies: product strategy, base of resources and experience, and capacity of the competitors.

-

The chefs want to make mayonnaise, using raw unpasteurised eggs. What is the maximum time they can keep the mayonnaise, even if it's kept refrigerated and why? Stuck? Please revisit Key factors in...

-

Describe how an understanding of managerial accounting would be helpful to a small business owner. What are the typical similarities and differences between the two types of accounting?

Study smarter with the SolutionInn App