Charlies Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying

Question:

Charlie’s Green Lawn Care is a cash basis taxpayer. Charlie Adame, the sole proprietor, is considering delaying some of his December 2018 customer billings for lawn care into the next year. In addition, he is thinking about paying some of the bills in late December 2018, which he would ordinarily pay in January 2019. This way, Charlie claims, he will have “less income and more expenses, thereby paying less tax!” Is Charlie’s way of thinking acceptable?

Transcribed Image Text:

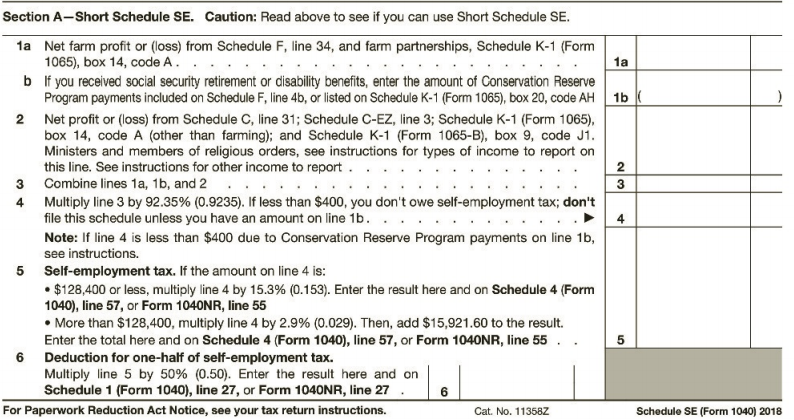

Section A-Short Schedule SE. Caution: Read above to see if you can use Short Schedule SE. 1a Net farm profit or (loss) from Schedule F, line 34, and farm partnerships, Schedule K-1 (Form 1065), box 14, code A. b If you received social security retirement or disability benefits, enter the amount of Conservation Reserve Program payments included on Schedule F, line 4b, or listed on Schedule K-1 (Form 1065), box 20, code AH 1b ( 2 Net profit or (loss) from Schedule C, line 31; Schedule C-EZ, line 3; Schedule K-1 (Form 1065), box 14, code A (other than farming); and Schedule K-1 (Form 1065-B), box 9, code Ji. Ministers and members of religious orders, see instructions for types of income to report on this line. See instructions for other income to report . 3 Combine lines 1a, 1b, and 2 4 Multiply line 3 by 92.35% (0.9235). If less than $400, you don't owe self-employment tax; don't file this schedule unless you have an amount on line 1b. 1a 2 Note: If line 4 is less than $400 due to Conservation Reserve Program payments on line 1b, see instructions. 5 Self-employment tax. If the amount on line 4 is: • $128,400 or less, multiply line 4 by 15.3% (0.153). Enter the result here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 • More than $128,400, multiply line 4 by 2.9% (0.029). Then, add $15,921.60 to the result. Enter the total here and on Schedule 4 (Form 1040), line 57, or Form 1040NR, line 55 . . 6 Deduction for one-half of self-employment tax. Multiply line 5 by 50% (0.50). Enter the result here and on Schedule 1 (Form 1040), line 27, or Form 1040NR, line 27 5 For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 11358z Schedule SE (Form 1040) 2018

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (15 reviews)

Unless otherwise restricted by law taxpayers can elect to use either ...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Is there a difference between a cash basis taxpayer and an accrual taxpayer regarding allowing a bad debt deduction?

-

1. Vernon is a cash basis taxpayer with a calendar tax year. On October 1, 2014 he entered into a lease to rent a building for use in his business at $3,000 a month. On that day Vernon paid 18 months...

-

Yolanda is a cash basis taxpayer with the following transactions during the year: Cash received from sales of products........... $65,000 Cash paid for expenses (except rent and interest)..........

-

Decedent died owning an insurance policy that would pay $2 million to Beneficiary. Six months later, the insurance company paid Beneficiary $2 million plus $50,000 interest. What portion of the...

-

Whyville Corporation obtained its charter from the state in January 2013, which authorized 500,000 shares of common stock, $1 par value. During the first year, the company earned $58,000 and the...

-

For each blank select one entry from the corresponding column of choices. Fill all blanks in the way that best completes the text. The ____(i)____ with which the second-string quarterback managed to...

-

Name three molecules that are able to move directly across the phospholipid bilayer of the cell membrane.

-

1. How did the laser cutter save Peerless Saw Company when it could not be justified on payback or ROI grounds? 2. Compare the decision Ted faces nowthe 1200-watt laser purchasewith the decision he...

-

What would Walmart's short-term and long-term goals look like for an online grocery delivery service?

-

According to Money magazine, Maryland had the highest median annual household income of any state in 2018 at $75,847 (Time.com website). Assume that annual household income in Maryland follows a...

-

Which of the following items is deductible as a miscellaneous deduction on Schedule A? a. Investment expenses b. Gambling losses to the extent of gambling winnings c. Unreimbursed business expenses...

-

The Au Natural Clothing Corporation has changed its year-end from a calendar yearend to March 31, with permission from the IRS. The income for its short period from January 1 to March 31 is $24,000....

-

For a rectangular weld-bead track resisting bending, develop the necessary equations to treat cases of vertical welds, horizontal welds, and weld-all-around patterns with depth d and width b and...

-

The Company System action Inc, wanted to know their net present value if they invest 10.0000 EUR today. The expected cash flows at the end of each years are 2000 EUR, 1500 EUR, 150 EUR and 3200 EUR,...

-

Explain how working effectively with people in an organisation can affect both commercial viability and sustainability. In your answer limit the application of sustainability to the 'three (3) or...

-

Complete the expressions. Write each answer as a number, a variable, or the product of a number and a variable. 5(6s+ 6) = 5.[ + 5.6 || + 30 Distributive property Multiply

-

f. (3 points) Now suppose you were considering a different transformation of the random variable Z. Suppose the transformation is of the form Y = 1/(Z - m). How would you pick the values for k and m...

-

Tech Data Corp. uses a perpetual inventory system. The following activities occurred during May: May 1 - Tech Data purchased $100,000 worth of inventory, on credit terms 2/10 n/30. May 3 - Tech Data...

-

Jessie Inc. had the following cost and fair market values for their investments: Istructions 1. Journalize the year-end revaluation entries required by Jessie Inc. 2. Prepare the relevant current and...

-

Find a polar equation for the curve represented by the given Cartesian equation. 4y 2 = x

-

On July 1, 2016, Ted, age 73 and single, sells his personal residence of the last 30 years for $368,000. Ted's basis in his residence is $42,000. The expenses associated with the sale of his home...

-

You have a problem and need a printed copy of Code Section 1033. Go to the U.S. House of Representatives' website (www.house.gov) and search for the "United States Code." The Internal Revenue Code is...

-

During 2016, Tom sold Sears stock for $10,000. The stock was purchased 4 years ago for $13,000. Tom also sold Ford Motor Company bonds for $35,000. The bonds were purchased 2 months ago for $30,000....

-

4. A partnership owns an aging 4-unit retail center in a local campus property. Cash flow projections for the next 10 years are: $50,000 for years 1 and 2; $60,000 for years 3 and 4; $70,000 for...

-

given A = 2 -2 3 ' 3 4 2 , 4 2 5 2 2 B= 3 -3 2 2 1 2 1 4 2 2 3 F= 4 2 3 - 2 -2 4 2 3 2 3 4 2 4 I Find the resulting matricas based on the arth metic operation. attach solution on your the comment...

-

The 40 members of a recreation class were asked to name their favorite sports. The table shows the numbers who responded in various ways. Use information given in the table to answer the following...

Study smarter with the SolutionInn App