Christopher Crosphit (age 42) owns and operates a health club called Catawba Fitness. The business is located

Question:

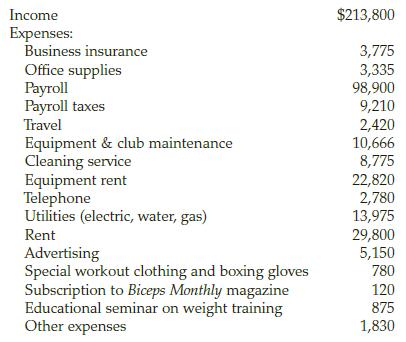

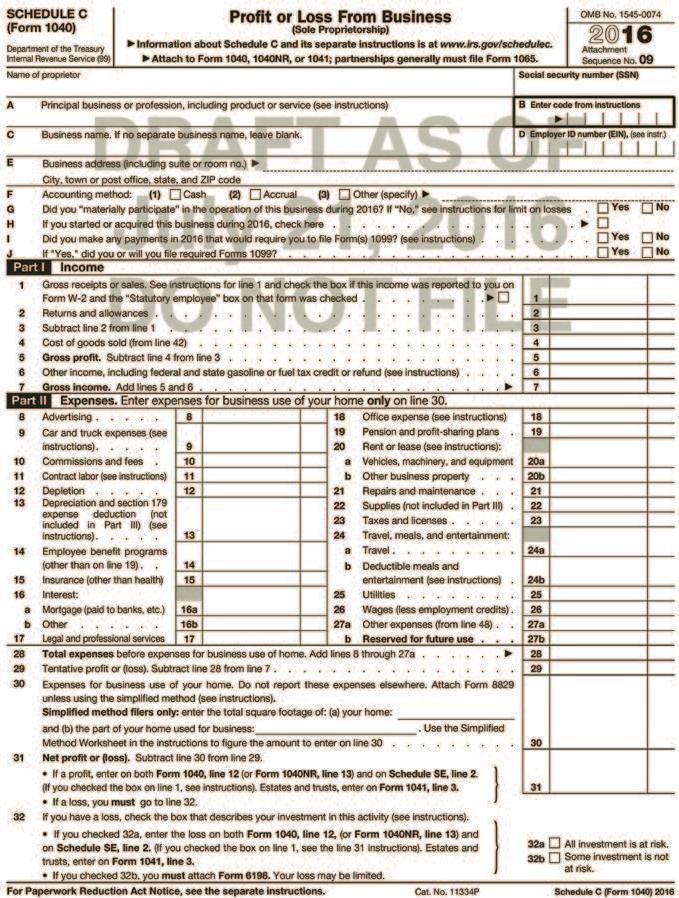

Christopher Crosphit (age 42) owns and operates a health club called “Catawba Fitness.” The business is located at 4321 New Cut Road, Spartanburg, SC 29303. The principal business code is 812190. Chris had the following income and expenses from the health club:

The business uses the cash method of accounting and has no accounts receivable or inventory held for resale.

Chris has the following interest income for the year:

Upper Piedmont Savings Bank savings account $12,831

Morgan Bank bond portfolio interest 11,025

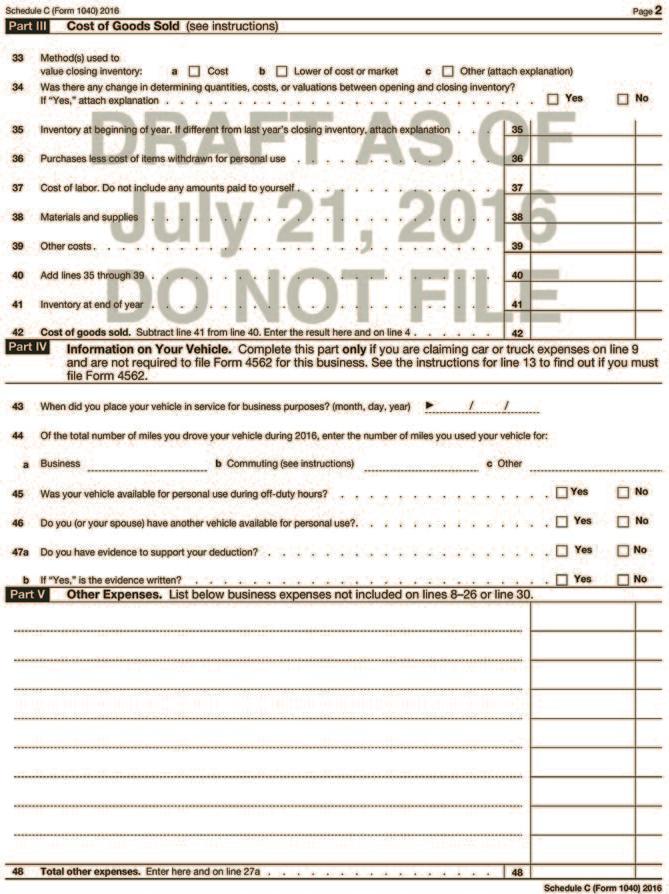

Chris has been a widower for 10 years with a dependent son, Arnold (Social Security number 276-23-3954), and he files his tax return as head of household. Arnold is an 18-year-old high school student; he does not qualify for the child tax credit. They live next door to the health club at 4323 New Cut Road. Chris does all the administrative work for the health club out of an office in his home. The room is 153 square feet and the house has a total of 1,800 square feet. Chris pays $20,000 per year in rent and $4,000 in utilities.

Chris’ Social Security number is 565-12-6789. He made an estimated tax payment to the IRS of $1,000 on April 15, 2016.

Required: Complete Chris’ federal tax return for 2016. Use Form 1040, Schedule B, Schedule C, and Form 8829, on Pages 3-49 to 3-52 and 3-57 to 3-59 to complete this tax return. Do not complete Form 4562 (depreciation). Make realistic assumptions about any missing data.

Form 1040:

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller