Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium.

Question:

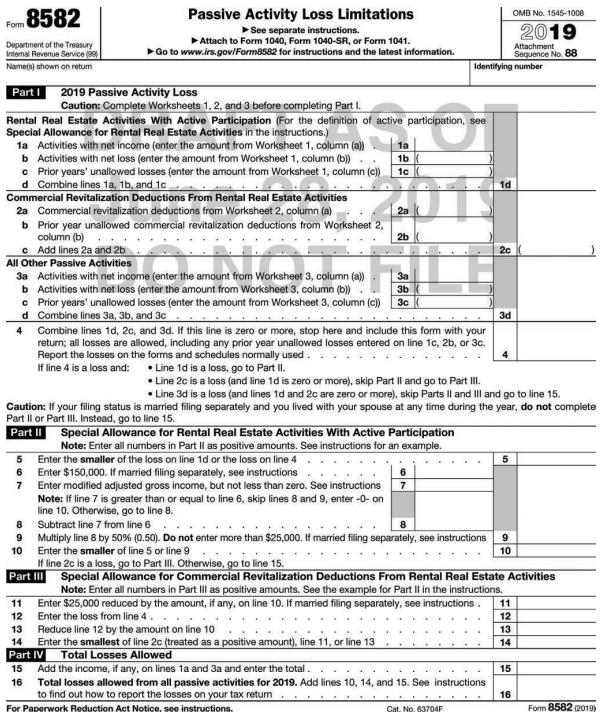

Clifford Johnson has a limited partnership investment and a rental condominium. Clifford actively manages the rental condominium. During 2019, his share of the loss from the limited partnership was $11,000, and his loss from the rental condo was $17,000. Assuming Clifford’s modified adjusted gross income is $124,000 for 2019, and he has no prior year unallowed losses from either activity, complete Form 8582 on Page 4-58.

Form 8582

Transcribed Image Text:

Passive Activity Loss Limitations OMB No. 1545-1008 Fom 8582 2019 Department of the Treasury Internal Revenue Service (99 See separate instructions. Attach to Form 1040, Form 1040-SR, or Form 1041. Go to www.irs.gov/Form8582 for instructions and the latest information. Attachment Sequence No. 88 Name(s) shown on retum Identifying number 2019 Passive Activity Loss Caution: Complete Worksheets 1, 2, and 3 before completing PartI. Part I Rental Real Estate Activities With Active Participation (For the definition of active participation, see Special Allowance for Rental Real Estate Activities in the instructions.) 1a Activities with net income (enter the amount from Worksheet 1, column (a) b Activities with net loss (enter the amount from Worksheet 1, column (b) c Prior years' unallowed losses (enter the amount from Worksheet 1, column (c) d Combine lines 1a, 1b. and 1c 1a 1b 1c 1d Commercial Revitalization Deductions From Rental Real Estate Activities 2a Commercial revitalization deductions from Worksheet 2, column (a) b Prior year unallowed commercial revitalization deductions from Worksheet 2, column (b) C Add lines 2a and 2b All Other Passive Activities 3a Activities with net income (enter the amount from Worksheet 3, column (a)) b Activities with net loss (enter the amount from Worksheet 3, column (b) c Prior years' unallowed losses (enter the amount from Worksheet 3, column (c) d Combine lines 3a, 3b, and 30 2a 2b 2c За 3b 30 INIONU 3d Combine lines 1d, 2c, and 3d. If this line is zero or more, stop here and include this form with your return; all losses are allowed, including any prior year unallowed losses entered on line 1c, 2b, or 3c. Report the losses on the forms and schedules normally used. If line 4 is a loss and: • Line 1d is a loss, go to Part II. 4 • Line 2c is a loss (and line 1d is zero or more), skip Part Il and go to Part II. • Line 3d is a loss (and lines 1d and 2c are zero or more), skip Parts Il and IIl and go to line 15. Caution: If your filing status is married filing separately and you lived with your spouse at any time during the year, do not complete Part Il or Part II. Instead, go to line 15. Part II Special Allowance for Rental Real Estate Activities With Active Participation Note: Enter all numbers in Part Il as positive amounts. See instructions for an example. Enter the smaller of the loss on line 1d or the loss on line 4 6. Enter $150,000. If married filing separately, see instructions Enter modified adjusted gross income, but not less than zero. See instructions Note: If line 7 is greater than or equal to line 6, skip lines 8 and 9, enter -0- on line 10. Otherwise, go to line 8. 6 7 7 8 Subtract line 7 from line 6. Multiply line 8 by 50% (0.50). Do not enter more than $25,000. If married filing separately, see instructions 10 9. 10 If line 2c is a loss, go to Part II. Otherwise, go to line 15. Part II Special Allowance for Commercial Revitalization Deductions From Rental Real Estate Activities Note: Enter all numbers in Part IIl as positive amounts. See the example for Part Il in the instructions. Enter $25,000 reduced by the amount, if any, on line 10. If married filing separately, see instructions. Enter the smaller of line 5 or line 9 11 11 12 Enter the loss from line 4. 12 13 Reduce line 12 by the amount on line 10 14 13 Enter the smallest of line 2c (treated as a positive amount), line 11, or line 13 Total Losses Allowed Add the income, if any, on lines 1a and 3a and enter the total. Total losses allowed from all passive activities for 2019. Add lines 10, 14, and 15. See instructions to find out how to report the losses on your tax retum 14 Part IV 15 15 16 16 For Paperwork Reduction Act Notice. see instructions. Form 8582 (2019) Cat. No. 63704F

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 54% (11 reviews)

Form 8582 Department of the Treasury Internal Revenue Service 99 Names shown on return Part I Clifford Johnson 2019 Passive Activity Loss Caution Complete Worksheets 1 2 and 3 before completing Part I ...View the full answer

Answered By

Jehal Shah

I believe everyone should try to be strong at logic and have good reading habit. Because If you possess these two skills, no matter what difficult situation is, you will definitely find a perfect solution out of it. While logical ability gives you to understand complex problems and concepts quite easily, reading habit gives you an open mind and holistic approach to see much bigger picture.

So guys, I always try to explain any concept keeping these two points in my mind. So that you will never forget any more importantly get bored.

Last but not the least, I am finance enthusiast. Big fan of Warren buffet for long term focus investing approach. On the same side derivatives is the segment I possess expertise.

If you have any finacne related doubt, do reach me out.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2020

ISBN: 9780357108239

38th Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Hanna is single Her modified adjusted gross income of $253,950 includes wages of $206,000, $2,500 of interest, $4,500 of tax exempt interest, $3,500 of dividends, $35,000 of rental income and $2,450...

-

Because there are _______, adjusted gross income is always ______ taxable income. a. Deductions and exemptions; less than b. Deductions and exemptions; greater than c. Credits; greater than d....

-

Nancy has active modified adjusted gross income before passive losses of $75,000. She has a loss of $5,000 on a rental property she actively manages. How much of the loss is she allowed to take...

-

Develop a data type Quote that implements the following API for quotations: To do so, define a nested class Card that holds one word of the quotation and a link to the next word in the quotation:...

-

Delineate the major characteristics of effective control systems. Discuss.

-

1.) What is meant by "diminishing marginal utility"? 2.) What are some things that you have/get where you experience diminishing marginal utility? Relatedly, what is happening to your total utility?

-

Consider the periodic signal \[f(t)=\left\{\begin{array}{lr}\cos (t)+D, & -1 \leq t \leq 0 \\\sin \left(t^{6} ight) / t^{3}, & 0 \leq t\leq 2\end{array} ight.\] where \(D=\sin \left(2^{6} ight) /...

-

1. Use ethical reasoning to evaluate the actions of Shell management in this case with respect to accounting for and disclosing information about proved reserves. 2. In chapter 7 we discussed...

-

2. Briefly explain the operating principles of a two-opening superimposed- waveguide directional coupler. 3. Briefly explain what are the main parameters used to compare directional couplers: the...

-

Project Alpha has two phases. You may invest in the first, in both, or in neither. The first phase requires an investment of $100 today. One year later, Alpha will deliver either $120 or $80, with...

-

Walter, a single taxpayer, purchased a limited partnership interest in a tax shelter in 1993. He also acquired a rental house in 2019, which he actively manages. During 2019, Walters share of the...

-

Tyler, a single taxpayer, generates a net operating loss of $12,000 in 2017 and elects to forego any carryback. He also generates a net operating loss of $6,000 in 2018. Finally, in 2019, Tylers...

-

The operating section of the 2008 consolidated statement of cash flows for Imation Corporation, a global technology company, is excerpted below (dollars in millions): Required(a) Review the trends...

-

A sample of 100 IQ scores produced the following statistics: Which statement(s) is (are) correct? (1) Half of the scores are less than 100. (2) The middle 50% of scores are between 70 and 120. (3)...

-

P(E c ) Find the indicated probabilities by referring to the given tree diagram and by using Bayess Rule. A P(A) = 0.2 P(E|A)=0.6 E P(ECA) = 0.4 -EC P(B) = 0.55 P(E|B)=0.7 -E B EC P(E|B) = 0.3 P(C) =...

-

P(E) Find the indicated probabilities by referring to the given tree diagram and by using Bayess Rule. A P(A) = 0.2 P(E|A)=0.6 E P(ECA) = 0.4 -EC P(B) = 0.55 P(E|B)=0.7 -E B EC P(E|B) = 0.3 P(C) =...

-

A sample of 100 IQ scores produced the following statistics: Which statement(s) is (are) correct? (1) Half of the scores are less than 95. (2) The middle 50% of scores are between 100 and 120. (3)...

-

Which of the three drag racers in Question 20 had the greatest acceleration at \(t=0 \mathrm{~s}\) ? A. Andy B. Betty C. Carl D. All had the same acceleration

-

Hull Company's record of transactions concerning part X for the month of April was as follows. Instructions: a. Calculate the inventory at April 30 on each of the following bases. Assume that...

-

The water in tank A is at 270 F with quality of 10% and mass 1 lbm. It is connected to a piston/cylinder holding constant pressure of 40 psia initially with 1 lbm water at 700 F. The valve is opened,...

-

On July 1, 2014, Ted, age 73 and single, sells his personal residence of the last 30 years for $365,000. Teds basis in his residence is $35,000. The expenses associated with the sale of his home...

-

Go to the IRS website (www.irs.gov) and redo Problem 7 using the most recent interactive Form 6252, Installment Sale Income. Print out the completed Form 6252.

-

During 2014, Tom sold Sears stock for $10,000. The stock was purchased 4 years ago for $13,000. Tom also sold Ford Motor Company bonds for $35,000. The bonds were purchased 2 months ago for $30,000....

-

Provide a comprehensive analysis of the regulatory frameworks governing financial institutions, delineating the intricate interplay between prudential supervision, market conduct standards, and...

-

How does the forum meet organisational objectives? What vocabulary, tone, structure and style suits the audience? How will I: build trust develop positive working relationships ...

-

If a set of m+1 data points (x,y) are to be represent by a least squares fit of y=c logx derive an expression for c in terms of x and y.

Study smarter with the SolutionInn App