David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037.

Question:

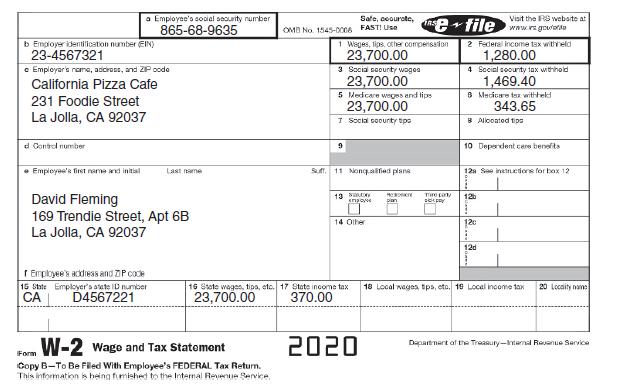

David Fleming is a single taxpayer living at 169 Trendie Street, Apartment 6B, La Jolla, CA 92037. His Social Security number is 865-68-9635 and his birthdate is September 18, 1975. David was employed as a delivery person for a local pizza restaurant. David’s W-2 showed the following:

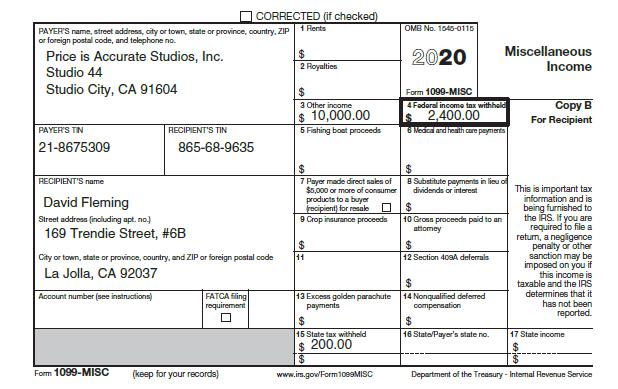

David’s only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC:

He has no other adjustments to income or deductible expenses except for a single cash payment of $500 to a charity after winning big at the game show and a $1,200 EIP received in 2020. Unfortunately, David’s employer did not provide health care to its employees but David signed up for coverage through his state’s health care exchange. The exchange sent him a Form 1095-A as shown on Page 7-61.

Required:

Complete David’s federal tax return for 2020. Use Form 1040, Schedule 1, Schedule 2, and Form 8962. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill