Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2020 of $47,000. He uses the

Question:

Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2020 of $47,000. He uses the standard deduction and has no dependents.

Transcribed Image Text:

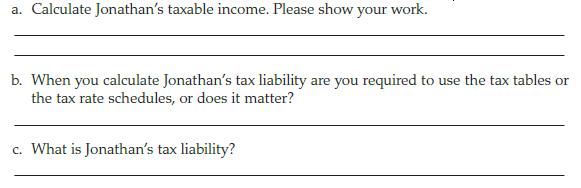

a. Calculate Jonathan's taxable income. Please show your work. b. When you calculate Jonathan's tax liability are you required to use the tax tables or the tax rate schedules, or does it matter? c. What is Jonathan's tax liability?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

a 34600 47000 12400 ...View the full answer

Answered By

GERALD KAMAU

non-plagiarism work, timely work and A++ work

4.40+

6+ Reviews

11+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Barry is 45 years old and a single taxpayer. In 2016, he has a gross income of $17,000 and itemized deductions of $6,500. If Barry claims an exemption on his 2016 income tax return, what is his...

-

Jonathan is a 35-year-old single taxpayer with adjusted gross income of $45,000. He uses the standard deduction and has no dependents. a. Calculate Jonathans taxable income. Please show your work....

-

Jonathan is a 35-year-old single taxpayer with adjusted gross income in 2018 of $46,300. He uses the standard deduction and has no dependents. a. Calculate Jonathans taxable income. Please show your...

-

Did you ever purchase a bag of M&??s candies and wonder about the distribution of colors? Did you know in the beginning they were all brown? Now, peanut M&Ms are 12% brown, 15% yellow, 12% red, 23%...

-

What is the purpose of a state machine diagram?

-

The following are exercises in future (terminal) values: a. At the end of three years, how much is an initial deposit of $100 worth, assuming a compound annual interest rate of (i) 100 percent? (ii)...

-

What is the purpose of an insurance policy?

-

Are New Belgiums social initiatives indicative of strategic philanthropy? Why or why not? Although most of the companies frequently cited as examples of ethical and socially responsible firms are...

-

Exercise 5A: Produce or buy an item The company BB Inc. manufactures part X for its annual production. The following table presents information on production costs at a certain level. Production...

-

Ramon, a single taxpayer with no dependents, has adjusted gross income for 2020 of $98,000 and his itemized deductions total $9,000. What taxable income will Ramon show in 2020? a. $74,950 b. $85,800...

-

Alicia, age 27, is a single, full-time college student. She earns $13,200 from a part time job and has taxable interest income of $1,450. Her itemized deductions are $845. Calculate Alicias taxable...

-

Write each expression in simplest radical form. If a radical appears in the denominator, rationalize the denominator. 75ab 2

-

Lim is a new pharmacist heavily in debt. A couple of Lims patients at the pharmacy who regularly received prescriptions for controlled substances told Lim they could make it worth his while if he...

-

Donna dies without a will, but with many relativesa spouse, children, adopted children, sisters, brothers, uncles, aunts, cousins, nephews, and nieces. Who gets what is determined by the states a....

-

Using the state pharmacy laws and rules from your state, does your state have any drug repository or take-back programs? If yes, describe the details.

-

John is a new pharmacist at XYZ Pharmacy. John noticed that the pharmacy kept the C-II drugs on the shelf interspersed with other drugs. All the other pharmacies where John had worked kept the C-IIs...

-

L and M are the only partners in LM Partnership. They decided to liquidate the partnership at a time when the balances in the two partners capital accounts were ($10,000) and $50,000, respectively....

-

Kamins Corporation has two bond issues outstanding, each with a par value of $1,000. Information about each is listed below. Suppose market interest rates rise 1 percentage point across the yield...

-

Question 6.10 Current and deferred tax worksheets and tax entries From the hip Ltd?s statement of profit or loss for the year ended 30 June 2007 and extracts from its statements of financial position...

-

Donna, age 42 and a single taxpayer, has a salary of $104,500 and interest income of $20,000. What is the maximum amount Donna can contribute to a Roth IRA? a. $5,000 b. $3,850 c. $6,000 d. $5,500 e....

-

What is the deadline for making a contribution to a traditional IRA or a Roth IRA for 2019? a. April 15, 2020 b. April 17, 2019 c. December 31, 2019 d. October 15, 2020

-

What is the maximum tax-deferred contribution that can be made to a Section 401(k) plan by an employee under age 50 in 2019? a. $19,000 b. $20,000 c. $18,500 d. $18,000 e. $56,000

-

We would like to cover a rectangular area by two kinds of tiles: 1 x 1 and 1 x 2 tiles (the 1 x 2 tiles can be rotated). Give a recurrence and boundary conditions for the number of ways to cover the...

-

Let F(x) = =1 tan (x-1) x < 1 sin (x 1) 1 x Find lim F(x). x+1+ lim F(x) = x+1+

-

2. Consider the graph G with vertices V = {1,2,3,4,5} and edges E {{1,2}. {2,3}, {3.1}, {3, 4}, {4, 5}, {5,1}}. (a) Draw G. (b) How many cycles does G have? List them. (c) Is G bipartite? Explain....

Study smarter with the SolutionInn App