Juanita contributes property with a fair market value of $30,000 and an adjusted basis of $16,000 to

Question:

Juanita contributes property with a fair market value of $30,000 and an adjusted basis of $16,000 to a partnership in exchange for an 10 percent partnership interest.

Transcribed Image Text:

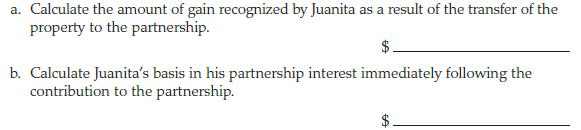

a. Calculate the amount of gain recognized by Juanita as a result of the transfer of the property to the partnership. $ b. Calculate Juanita's basis in his partnership interest immediately following the contribution to the partnership. 69

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (4 reviews)

a 0 b 16000 The ...View the full answer

Answered By

Utsab mitra

I have the expertise to deliver these subjects to college and higher-level students. The services would involve only solving assignments, homework help, and others.

I have experience in delivering these subjects for the last 6 years on a freelancing basis in different companies around the globe. I am CMA certified and CGMA UK. I have professional experience of 18 years in the industry involved in the manufacturing company and IT implementation experience of over 12 years.

I have delivered this help to students effortlessly, which is essential to give the students a good grade in their studies.

3.50+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

1. Jay contributes a property with a fair market value of $16,000 and an adjusted basis of $5,000 to a partnership in exchange for an 8 percent partnership interest. a . Calculate the amount of gain...

-

1. Betty contributed property with a $40,000 basis and fair market value of $85,000 to the Rust Partnership in exchange for a 50% interest in partnership capital and profits. During the first year of...

-

Multiple choice Questions: 1. Which of the following is not a partnership for tax purposes? a. Willis and James purchase and operate a shoe store. b. Sharon and Gary operate an accounting practice...

-

StudentGrades.java import java.io.File; import java.io.FileReader; import java.io.IOException; import java.io.PrintWriter; import java.util.Map; import java.util.Scanner; import java.util.Set; import...

-

Did a majority of the board of directors have a conflict of interest? Was demand on the board futile? Pierre M. Omidyar and Jeffrey Skoll founded eBay, Inc., a company that hosts an online auction...

-

Suppose that the spot price of the Canadian dollar is U.S. $0.95 and that the Canadian dollar/U.S. dollar exchange rate has a volatility of 8% per annum. The risk-free rates of interest in Canada and...

-

a. Beginning with the score function for the logit case in equation (11.5), show that the information matrix can be expressed as \[\mathbf{I}(\boldsymbol{\beta})=\sum_{i=1}^{n} \sigma_{i}^{2}...

-

On January 1, 2018, Cameron Inc. bought 20% of the outstanding common stock of Lake Construction Company for $300 million cash. At the date of acquisition of the stock, Lake's net assets had a fair...

-

There is a debt of $9,000 payable in 3 installments of $3,000 at 60, 180 and 300 days. This debt will be paid in 3 quarterly payments: one of $1,000 and the other of $2,000. If the agreed rate is 60%...

-

Abigail contributes land with an adjusted basis of $50,000 and a fair market value of $60,000 to Blair and Partners, a partnership. Abigail receives a 50 percent interest in Blair. What is Abigails...

-

Abigail contributes land with an adjusted basis of $50,000 and a fair market value of $60,000 to Blair and Partners, a partnership. Abigail receives a 50 percent interest in Blair. What is Blairs...

-

The accompanying graphs show the first ionization energies and electron affinities of the period 3 elements. Refer to the graphs to answer the questions that follow. a. Describe the general trend in...

-

What are some of the advantages of holding companies? Identify a disadvantage.

-

How are preliminary levels of debt, preferred stock, common stock, and dividends projected?

-

What is a holding company?

-

How are operating items projected on financial statements?

-

What are some defensive tactics that firms can use to resist hostile takeovers?

-

ODell Enterprises manufactures lenses for telescopes. ODell is considering replacing a machine that grinds lenses and has received a proposal from a vendor for the new lens grinder. ODell has a 12...

-

What is the ideal number of children to have? This question was asked on the Sullivan Statistics Survey I. Draw a dot plot of the variable Children from theSullivanStatsSurveyI data set at...

-

Margaret started her own business in the current year and will report a profit for her first year. Her results of operations are as follows: What is the net income Margaret should show on her...

-

Kevin owns a retail store, and during the current year he purchased $610,000 worth of inventory. Kevins beginning inventory was $67,000, and his ending inventory is $77,200. During the year, Kevin...

-

Go to the IRS website (www.irs.gov) and find the most recent IRS Publication 538, Accounting Periods and Methods. Print out the first two pages of the part on inventories.

-

Some people think of crime as that which is immoral. Explain why morality helps little in determining whether specific acts should be considered criminal.

-

What is encoded into the act of riding in traditional African sculpture?

-

A 1524 mm (5 5 ft) reinforced concrete box culvert with 254 mm (10 in.) sidewalls is installed with its top 914 mm (3 ft) above the adjacent natural ground level. What is the projection ratio for...

Study smarter with the SolutionInn App