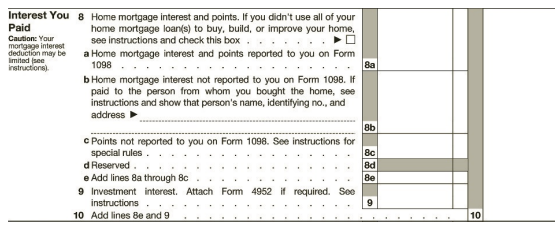

Ken paid the following amounts for interest during 2018: 3 Qualified interest on home mortgage.................$4,800 Auto loan

Question:

Ken paid the following amounts for interest during 2018: 3

Qualified interest on home mortgage.................$4,800

Auto loan interest.................850

“Points” on the mortgage for acquisition of his personal residence.................400

Service charges on his checking account.................40

Mastercard interest.................300

Calculate Ken’s itemized deduction for interest on the following portion of Schedule A.

Transcribed Image Text:

Interest You 8 Home mortgage interest and points. If you didn't use all of your home mortgage loan(s) to buy, build, or improve your home, see instructions and check this box. . a Home mortgage interest and points reported to you on Form 1098 . Paid Caution: Your mortgage interest deduction may be Imited (see instructions). 8a b Home mortgage interest not reported to you on Form 1098. If paid to the person from whom you bought the home, see instructions and show that person's name, identifying no., and address 8b C Points not reported to you on Form 1098. See instructions for special rules. d Reserved. e Add lines 8a through 8c 9 Investment interest. Attach Form 4952 if required. See instructions 8c 8d 8e 10 Add lines 8e and 9 10

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

a 4800 400 Other interest is nondeductible personal interest Interest You 8 Hom...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Ken paid the following amounts for interest during 2016: Qualified interest on home mortgage .......................................................... $4,800 Auto loan interest...

-

Ken paid the following amounts for interest during 2012: Qualified interest on home mortgage...........................................$4,700 Auto loan...

-

Ken paid the following amounts for interest during 2015: Qualified interest on home mortgage ............................ $4,700 Auto loan interest ......................................................

-

EG Corporation redeemed 200 shares of stock from one of its shareholders in exchange for $200,000. The redemption represented 20% of the corporation's outstanding stock. The redemption was treated as...

-

Southwest Corporation issued bonds with the following details: Face value: $600,000 Interest: 9 percent per year payable each December 31 Terms: Bonds dated January 1, 2012, due five years from that...

-

Circle all pronouns and rewrite to correct any pronoun errors. Although one should never read carelessly, you should move briskly through the page to maintain focus on the purpose behind the text.

-

Mae contracted to sell one thousand bushels of wheat to Lloyd at \($10.00\) per bushel. Just before Mae was to deliver the wheat, Lloyd notified her that he would not receive or accept the wheat. Mae...

-

Jude Corporation has been authorized to issue 20,000 shares of $100 par value, 10%, noncumulative preferred stock and 1,000,000 shares of no-par common stock . The corporation assigned a $2.50 stated...

-

Prices of Athletic Shoes Prices (in dollars) of mens, womens, and childrens athletic shoes are shown. At the 0.05 level of significance, can it be concluded that there is a difference in mean price?

-

Santana Rey, owner of Business Solutions, decides to prepare a statement of cash flows for her business. (Although the serial problem allowed for various ownership changes in earlier chapters, we...

-

In 2018, Irene, an unmarried individual, pays $6,500 in qualified adoption expenses to an adoption agency for the final adoption of an eligible child who is not a child with special needs. In the...

-

The itemized deduction for state and local in taxes in 2018 is a. Total taxes less 7.5% of AGI b. Limited to no more than $10,000 c. Unlimited d. Only deductible if the taxes are business related e....

-

GG Corporation, a private corporation, was formed on July 1, 2018. On July 31, Guy Glinas, the company's president, prepared the following statement of financial position: Guy admits that his...

-

How to write an evaluation and analysis of your personal communication strengths and weakness as well how you communication within organizations.?

-

Lupa is in the market for an insurance product that will provide income during her retirement. Lupa is scared that if she buys an "annuity" and she were to die shortly thereafter, she would "lose"...

-

Write a cover letter for cooperative internship. Practicing A COVER LETTER about an application for cooperative internship. Intro Paragraph What program are you in? Why are you writing this...

-

How does social inequality, on a micro and macro level, perpetuates poverty. explain briefly

-

How you might incorporate elements of transition and self-advocacy into your daily/weekly routine with students in your co-teaching or itinerant teaching scenario. Identify some activities that you...

-

The following items were selected from among the transactions completed by Pot of Gold Coffee Ltd., a private coffee importing company with a May 31 year-end. 2015 Jul. 10. Purchased merchandise on...

-

Rewrite Programming Exercise 7.5 using streams. Display the numbers in increasing order. Data from Programming Exercise 7.5 Write a program that reads in 10 numbers and displays the number of...

-

Stewie, a single taxpayer, operates an activity as a hobby. Brian operates a similar activity as a bona fide business. Stewies gross income from his activity is $5,000 and his expenses are $6,000....

-

All of the following assets are capital assets, except: a. A personal automobile b. IBM stock c. A childs bicycle d. Personal furniture e. Used car inventory held by a car dealer

-

Which of the following is a capital asset? a. Account receivable b. Copyright created by the taxpayer c. Copyright (held by the writer) d. Business inventory e. A taxpayers residence

-

. For each of these relations, write down all functional dependencies. If there are no functional dependencies among attributes, you must state so. Do not write down trivial functional dependencies,...

-

and b = 3. 7.3a=2*b 8.(5-a)*b <7 9.b

-

What diameter of vertical tube would allow mayonnaise (= 1,200 kg/m3) to flow under its own weight?

Study smarter with the SolutionInn App