Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that

Question:

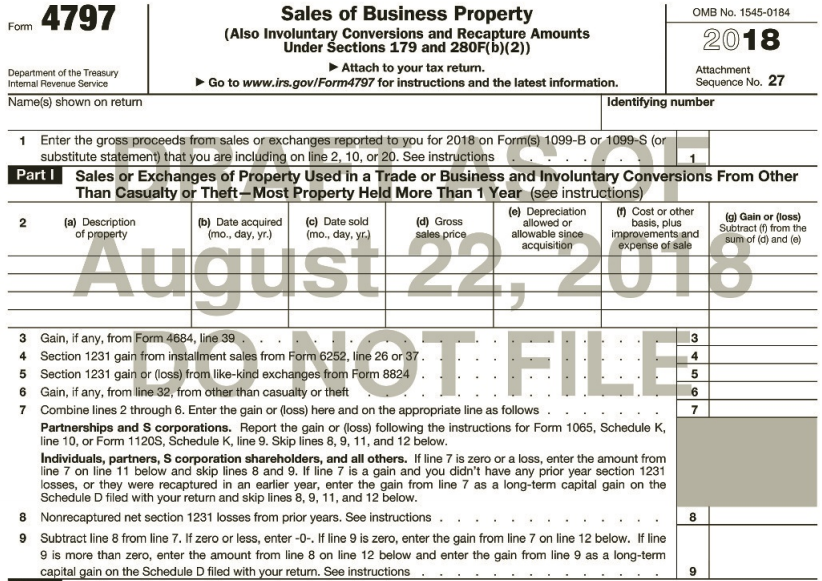

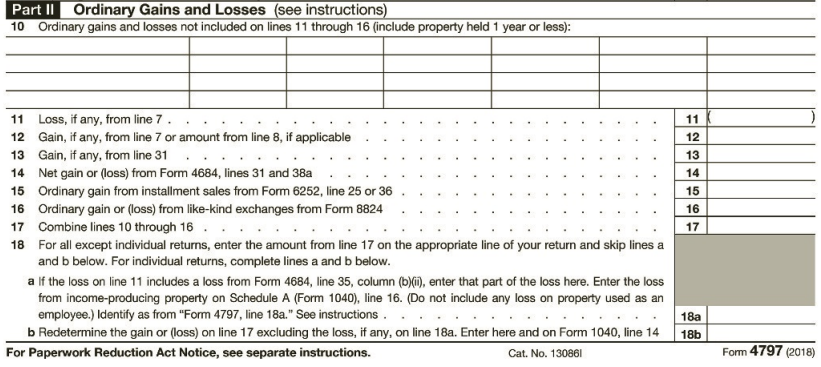

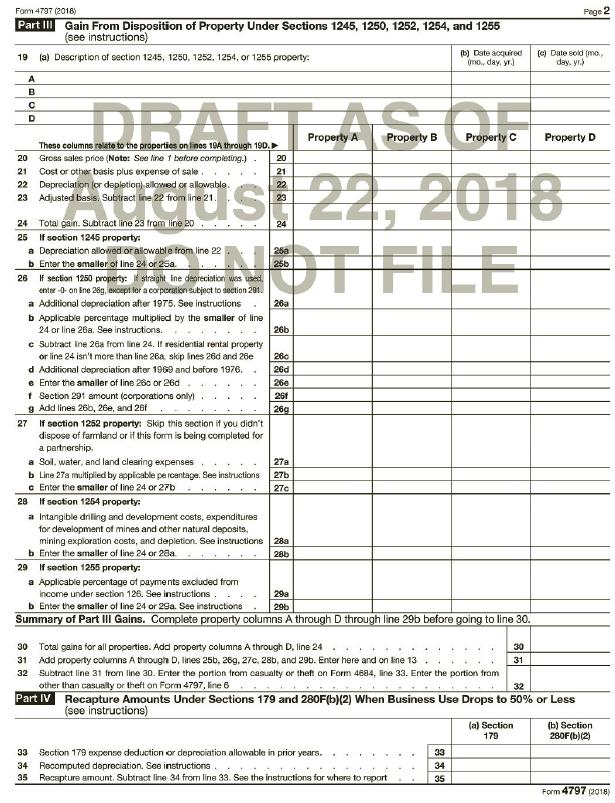

Nadia Shalom has the following transactions during the year: Sale of office equipment on March 15 that cost $19,000 when purchased on July 1, 2016. Nadia has claimed $3,000 in depreciation and sells the asset for $13,000 with no selling costs. Sale of land on April 19 for $124,000. The land cost $132,000 when purchased on February 1, 2007. Nadia’s selling costs are $6,000. Assume there were no capital improvements on either business asset sold. Nadia’s Social Security number is 924565783. Complete Form 4797 on Pages 845 and 846 to report the above gains or losses.

Transcribed Image Text:

4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Šections 179 and 280F(b)(2)) OMB No. 1545-0184 Form 2018 Attach to your tax return. Attachment Department of the Treasury Internal Revenue Service Go to www.irs.gov/Form4797 for instructions and the latest information. Sequence No. 27 Name(s) shown on return Identifying number 1 Enter the gross proceeds from sales or exchanges reported to you for 2018 on Form(s) 1099-B or 1099-S (or substitute statement) that you are including on line 2, 10, or 20. See instructions Part I Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft-Most Property Held More Than 1 Year (see instructions) () Cost or other basis, plus improvements and expense of sale (e) Depreciation (a) Gain or (loss) Subtract (f) from the sum of (d) and (e) (c) Date sold (mo., day, yr.) (d) Gross sales price allowed or allowable since acquisition (a) Description of property (b) Date acquired (mo., day, yr.) August 22, 2018 ENOT FILE 3 Gain, if any, from Form 4684, line 39 13 4 Section 1231 gain from installment sales from Form 6252, line 26 or 37. 5 Section 1231 gain or (loss) from like-kind exchanges from Form 8824 6 Gain, if any, from line 32, from other than casualty or theft 7 Combine lines 2 through 6. Enter the gain or (loss) here and on the appropriate line as follows Partnerships and S corporations. Report the gain or (loss) following the instructions for Form 1065, Schedule K, line 10, or Form 1120S, Schedule K, line 9. Skip lines 8, 9, 11, and 12 below. Individuals, partners, S corporation shareholders, and all others. If line 7 is zero or a loss, enter the amount from line 7 on line 11 below and skip lines 8 and 9. If line 7 is a gain and you didn't have any prior year section 1231 losses, or they were recaptured in an earlier year, enter the gain from line 7 as a long-term capital gain on the 8 Nonrecaptured net section 1231 losses from prior years. See instructions . 9 Subtract line 8 from line 7. If zero or less, enter -0-. If line 9 is zero, enter the gain from line 7 on line 12 below. If line 9 is more than zero, enter the amount from line 8 on line 12 below and enter the gain from line 9 as a long-term capital gain on the Schedule D filed with your return. See instructions 8. Part II Ordinary Gains and Losses (see instructions) 10 Ordinary gains and losses not included on lines 11 through 16 (include property held 1 year or less): 11 Loss, if any, from line 7. 11 12 Gain, if any, from line 7 or amount from line 8, if applicable 13 Gain, if any, from line 31 14 Net gain or (loss) from Form 4684, lines 31 and 38a 15 Ordinary gain from installment sales from Form 6252, line 25 or 36 16 Ordinary gain or (loss) from like-kind exchanges from Form 8824 17 Combine lines 10 through 16 . 12 13 14 15 16 17 18 For all except individual returns, enter the amount from line 17 on the appropriate line of your return and skip lines a and b below. For individual returns, complete lines a and b below. a lf the loss on line 11 includes a loss from Form 4684, line 35, column (b)(i1), enter that part of the loss here. Eter the loss from income-producing property on Schedule A (Form 1040), line 16. (Do not include any loss on property used as an employee.) Identify as from "Form 4797, line 18a." See instructions. .. b Redetermine the gain or (loss) on line 17 excluding the loss, if any, on line 18a. Enter here and on Form 1040, line 14 18a 18b For Paperwork Reduction Act Notice, see separate instructions. Cat. No. 130861 Form 4797 (2018)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

4797 Department of the Treasury Internal Revenue Service Names shown on return Form 2 Sales of Business Property Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280Fb2 a Desc...View the full answer

Answered By

Michael Mulupi

I am honest,hardworking, and determined writer

4.70+

72+ Reviews

157+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

The speed of light is related to wavelength and frequency by where is the speed of light (2.99 10 5 ), is the wavelength in metres (m), is the frequency in hertz (Hz). Given wavelength is 3.50 10...

-

The Totman Company has the following transactions during the months of January and February: The cost of the inventory at January 1 is $24, $23, and $15 per unit, respectively, under the FIFO,...

-

The Gargantuan Company has the following transactions during December. Prepare a combined cost of goods sold and Income Statement showing all these transactions and identify the value of inventory to...

-

Passenger table (passengerid, address etc.) Flight table (flight id, departure, destination, depDate) Booking table (cID, fid, date, cost) a. Find Passengers who live in Chicago b. Total number of...

-

Calculate the amount of depreciation to report during the year ended December 31, 2013, for equipment that was purchased at a cost of $43,000 on October 1, 2013. The equipment has an estimated...

-

On July 2, 2023, Efficient Energy Services performed an energy audit for an industrial client and earned $4,000 of revenue on account. On July 14, 2023, the company received a cheque for the entire...

-

Is there a significant difference in the economic content of balance sheets created by for-profit (investor-owned) and not-for-profit healthcare organizations?

-

Thermal Rising, Inc., makes paragliders for sale through specialty sporting goods stores. The company has a standard paraglider model, but also makes custom-designed paragliders. Management has...

-

Morning Dove Company manufactures one model of birdbath, which is very popular. Morning Dove sells all units it produces each month. The relevant range is 0 to 1,600 units, and monthly production...

-

The following liquid-phase reactions were carried out in a CSTR at 325 K. kLA = 7.0 min- - B+C k0 = 3.0 dm mol?-min 2C+A- 3D dm mol min 4D+3C 3E kE = 2.0 !!

-

Jeanie acquires an apartment building in 2007 for $250,000 and sells it for $500,000 in 2018. At the time of sale there is $75,400 of accumulated straightline depreciation on the apartment building....

-

Virginia has business property that is stolen and partially destroyed by the time it was recovered. She receives an insurance reimbursement of $6,000 on property that had a $14,000 basis and a...

-

For the following paired datasets, a paired sign test will be performed. Calculate S + . a. b. c. 11 10 7 13 6 9 11 12 13 7 5 G. 12

-

For the case of European call options, we shall prove that The call options price is increasing with respect to the asset price and The call options price is convex with respect to the asset price....

-

A particle is placed in a superposition of eight states, which are all eigenfunctions of the operator 2. The eigenfunctions (numbered Y to Yg) have distinct eigenvalues (w to wg) which are...

-

The population, P, of a town increases as the following equation: P(t) = Poe0.25t If P(4) == 200, what is the initial population?

-

How do modern operating systems handle power management strategies, such as dynamic frequency scaling, sleep states, and power-aware scheduling, to optimize energy consumption in mobile and embedded...

-

2. Suppose Delta Airlines buys a Boeing 777-9 for $500 million. The airplane lasts for 25 years and then must be scrapped, with no salvage value. Assume it depreciates uniformly by $20 million a...

-

Organic Health Inc. is a distributor of health food products in the Toronto area. The following account balances appear on the balance sheet of Organic Health Inc.: $2 preferred shares (100,000...

-

Calculate the change in entropy when 100 kJ of energy is transferred reversibly and isothermally as heat to a large block of copper at (i) 0 C, (ii) 50 C.

-

The amortization period for Section 197 intangibles is: a. 5 years b. 7 years c. 10 years d. 15 years e. 40 years

-

Tupper Corp. purchases a new auto in 2022 for $62,000. The auto is used 100 percent for business and the half-year convention applies. Tupper uses bonus depreciation when available. What is the 2023...

-

Tom has a successful business with $100,000 of taxable income before the election to expense in 2022. He purchases one new asset in 2022, a new machine which is seven-year MACRS property and costs...

-

Link to Digital Profile/Portfolio 2. You are taking a database snapshot of your RDS instance. What would be the impact to the I/O operations while taking snapshots? 3. What is the maximum size of RDS...

-

Define Divide and Conquer Run the simulation of merge sort in: https://www.hackerearth.com/practice/algorithms/sorting/merge-sort/visualize/ (not a question) Explain the algorithm of merge sort? Does...

-

Ask a non-IT person (your friend, child) how the Web is different from the Internet. Quote the most interesting part of their answer and then critique it based on what you know. Explain the process...

Study smarter with the SolutionInn App