Philcon Corporation created the following 2018 employee payroll report for one of its employees. a. Complete the

Question:

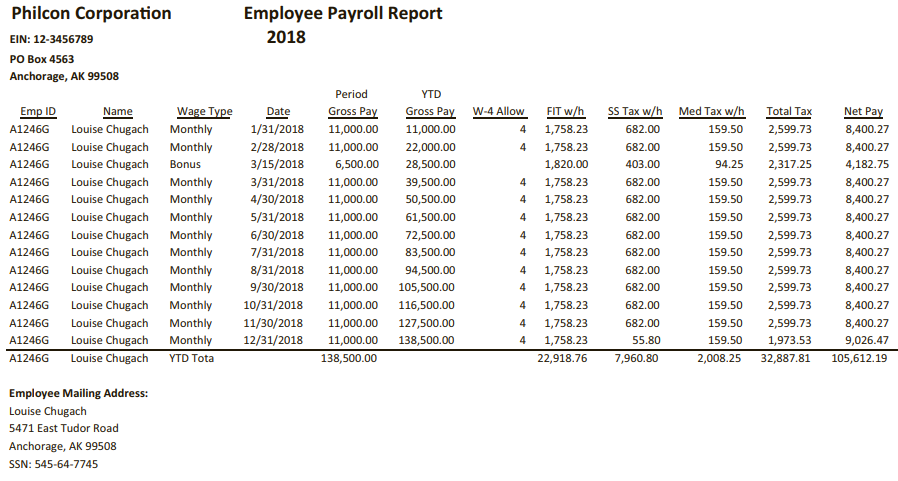

Philcon Corporation created the following 2018 employee payroll report for one of its employees.

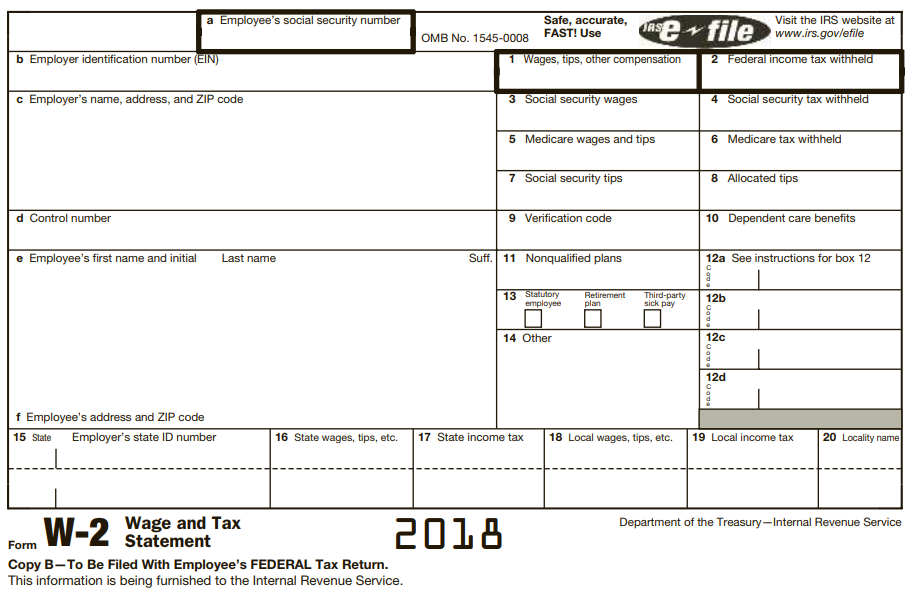

a. Complete the following Form W-2 for Louise Chugach from Philcon Corporation.

b. Philcon Corporation also paid $1,100 to Ralph Kincaid for presenting a management seminar. Ralph lives at 1455 Raspberry Road, Anchorage AK 99508, and his Social Security number is 475-45-3226. Complete the Form 1099-MISC located on Page 9-45 for the payment to Ralph from Philcon Corporation.

Transcribed Image Text:

Philcon Corporation Employee Payroll Report 2018 EIN: 12-3456789 PO Box 4563 Anchorage, AK 99508 Period YTD W-4 Allow Gross Pay 11,000.00 Gross Pay 11,000.00 FIT w/h SS Tax w/h Med Tax w/h Emp ID Wage Type Name Louise Chugach Louise Chugach Date 1/31/2018 Total Tax Net Pay Monthly 682.00 2,599.73 A1246G 1,758.23 159.50 8,400.27 2/28/2018 11,000.00 22,000.00 2,599.73 8,400.27 A1246G Monthly 4 1,758.23 682.00 159.50 A1246G 3/15/2018 Louise Chugach Bonus 6,500.00 28,500.00 1,820.00 403.00 94.25 2,317.25 4,182.75 Louise Chugach Monthly 3/31/2018 11,000.00 A1246G 39,500.00 1,758.23 682.00 159.50 2,599.73 8,400.27 50,500.00 Louise Chugach 4/30/2018 A1246G Monthly 11,000.00 1,758.23 682.00 159.50 2,599.73 8,400.27 Louise Chugach Monthly 5/31/2018 11,000.00 61,500.00 A1246G 4 1,758.23 682.00 159.50 2,599.73 8,400.27 Louise Chugach 6/30/2018 A1246G Monthly 11,000.00 72,500.00 1,758.23 682.00 159.50 2,599.73 8,400.27 Louise Chugach Monthly 7/31/2018 11,000.00 83,500.00 A1246G 1,758.23 682.00 159.50 2,599.73 8,400.27 Louise Chugach 8/31/2018 94,500.00 A1246G Monthly 11,000.00 1,758.23 682.00 159.50 2,599.73 8,400.27 Louise Chugach Monthly 9/30/2018 11,000.00 A1246G 105,500.00 4 1,758.23 682.00 159.50 2,599.73 8,400.27 Louise Chugach Monthly 10/31/2018 2,599.73 8,400.27 A1246G 11,000.00 116,500.00 4 1,758.23 682.00 159.50 11/30/2018 Louise Chugach Monthly 682.00 159.50 A1246G 11,000.00 127,500.00 1,758.23 2,599.73 8,400.27 12/31/2018 138,500.00 A1246G Louise Chugach Monthly 11,000.00 1,758.23 55.80 159.50 1,973.53 9,026.47 Louise Chugach YTD Tota 138,500.00 7,960.80 A1246G 32,887.81 22,918.76 2,008.25 105,612.19 Employee Mailing Address: Louise Chugach 5471 East Tudor Road Anchorage, AK 99508 SSN: 545-64-7745 a Employee's social security number Safe, accurate, FAST! Use Visit the IRS website at Tasefile www.irs.gov/efile RS OMB No. 1545-0008 b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 7 Social security tips 8 Allocated tips d Control number 9 Verification code 10 Dependent care benefits e Employee's first name and initial Suff. 11 Nonqualified plans 12a See instructions for box 12 Last name 13 Statutory employee Retirement plan Third-party sick pay 12b 14 Other 12c 12d f Employee's address and ZIP code Employer's state ID number 15 State 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 19 Local income tax 20 Locality name Department of the Treasury-Internal Revenue Service W-2 Wage and Tax 2018 Statement Form Copy B-To Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (14 reviews)

a b b Employer identification number EIN 123456789 c Employers name address and ZIP code Philcon Cor...View the full answer

Answered By

Pushpinder Singh

Currently, I am PhD scholar with Indian Statistical problem, working in applied statistics and real life data problems. I have done several projects in Statistics especially Time Series data analysis, Regression Techniques.

I am Master in Statistics from Indian Institute of Technology, Kanpur.

I have been teaching students for various University entrance exams and passing grades in Graduation and Post-Graduation.I have expertise in solving problems in Statistics for more than 2 years now.I am a subject expert in Statistics with Assignmentpedia.com.

4.40+

3+ Reviews

10+ Question Solved

Related Book For

Income Tax Fundamentals 2019

ISBN: 9781337703062

37th Edition

Authors: Gerald E. Whittenburg, Steven Gill

Question Posted:

Students also viewed these Business questions

-

Nanco is a company that makes custom signs and has 12 employees. The owner wants to perform a benefits analysis report for one of its employees, Ben Loomes. Ben's benefits package is as follows?

-

Cloudy Night Signs is a company that makes custom signs and has 12 employees. The owner wants to perform a benefits analysis report for one of its employees, Howard Nelson. Howards benefits package...

-

Philcon Corporation (P.O. Box 4563, Anchorage, AK 99508; EIN 12-3456789) paid Louise Chugach, an employee who lives at 5471 East Tudor Road, Anchorage, AK 99508, wages of $24,554 in 2015. The...

-

Gerald De Beer is a 38-year-old vibrant, outgoing young man who has been employed as a digital artist at Innovate Tech Solutions (Pty) Ltd ("Innovate Tech") since 1 May 2019. Details of Geralds...

-

Access the Wiki Art Gallery (WAG) instructional case in Connect, and read the case in sufficient depth to answer the following questions. 1. What inventory costing method(s) does Wiki Art Gallery...

-

How many two-letter codes can be formed using the letters A, B, C, and D? Repeated letters are allowed.

-

5. I like to let people know when they have done something right. True or False

-

Cash budgetcomprehensive Following are the budgeted income statements for the second quarter of 2013 for SeaTech, Inc.: * Includes all product costs (i.e., direct materials, direct labor, and...

-

Peanut Company acquired 90 percent of Snoopy Company's outstanding common stock for $292,500 on January 1, 20X8, when the book value of Snoopy's net assets was equal to $325,000. Peanut uses the...

-

Project Alpha has two phases. You may invest in the first, in both, or in neither. The first phase requires an investment of $100 today. One year later, Alpha will deliver either $120 or $80, with...

-

Tyler, a single taxpayer, generates a net operating loss of $12,000 in 2017. He also generates a net operating loss of $6,000 in 2018. Finally, in 2019, Tylers business turns a corner and he...

-

Kevin purchased a house 20 years ago for $100,000 and he has always lived in the house. Three years ago Kevin married Karen, and she has lived in the house since their marriage. If they sell Kevins...

-

What is a eutectic? What is the difference between a eutectic- forming system and a solid-solution-forming system?

-

Drs. Draper and Keys run a partnership family medical practice in Brownsville, Texas. While the practice is profitable, both physicians are making payments on heavy debt loads for student loans that...

-

Sweetlip Ltd and Warehou Ltd are two family-owned flax-producing companies in New Zealand. Sweetlip Ltd is owned by the Wood family and the Bradbury family owns Warehou Ltd. The Wood family has only...

-

Small Sample Weights of M&M plain candies are normally distributed. Twelve M&M plain candies are randomly selected and weighed, and then the mean of this sample is calculated. Is it correct to...

-

Swain Athletic Gear (SAG) operates six retail outlets in a large Midwest city. One is in the center of the city on Cornwall Street and the others are scattered around the perimeter of the city....

-

The Tokyo Olympics After watching How the Tokyo Olympics Became the Most Expensive Summer Game Ever video answer the following questions. * * The numbers can be made up . I just need help with an...

-

Show that the function xy has symmetry species B 2 in the group C 4v .

-

Halley's comet travels in an ellipti- cal orbit with a = 17.95 and b = 4.44 and passes by Earth roughly every 76 years. Note that each unit represents one astronomical unit, or 93 million miles. The...

-

Go to the IRS website (www.irs.gov) and print out a copy of the most recent Instructions for Schedule R of Form 1040.

-

Patty Banyan is a single taxpayer living at 543 Space Drive, Houston, TX 77099. Her Social Security number is 466-33-1234. For 2016, Patty has no dependents, and her W-2, from her job at a local...

-

Leslie and Leon Lazo are married and file a joint return for 2016. Leslies Social Security number is 466-47-3311 and Leons is 467-74-4451. They live at 143 Snapdragon Drive, Reno, NV 82102. For 2016,...

-

Only need help on 4B and 5. Exercise 9-21 Breakeven Planning; Profit Planning (LO 9-2, 9-3] Connelly Inc., a manufacturer of quality electric ice cream makers, has experienced a steady growth in...

-

A project with an initial cost of $32,000 is expected to provide cash flows of $12,900, $13,100, $16,200, and $10,700 over the next four years, respectively. If the required return is 8.1 percent,...

-

A company that is expecting to receive EUR 500,000 in 60 days is considering entering into an FX futures contract to lock an exchange rate to USD for the transaction. The FX rate on the contract is...

Study smarter with the SolutionInn App