Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10.

Question:

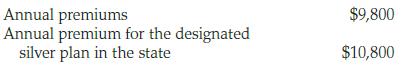

Susan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2020, Susan’s income is $43,120 and Stan’s is $12,000 and both are self-employed. They also have $500 in interest income from tax-exempt bonds. The Collins enrolled in health insurance for all of 2020 through their state exchange but did not elect to have the credit paid in advance. The 2020 Form 1095-A that the Collins received from the exchange lists the following information:

Compute the Collins’ premium tax credit for 2020.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted: