The following additional information is available for the Albert and Allison Gaytor family. The Gaytors own a

Question:

The following additional information is available for the Albert and Allison Gaytor family.

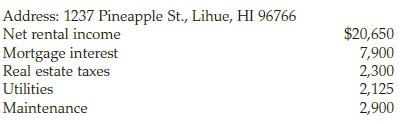

The Gaytors own a rental beach house in Hawaii. The beach house was rented for the full year during 2016 and was not used by the Gaytors during the year. The Gaytors were active participants in the management of the rental house. Pertinent information about the rental house is as follows:

The house is fully depreciated so there is no depreciation expense.

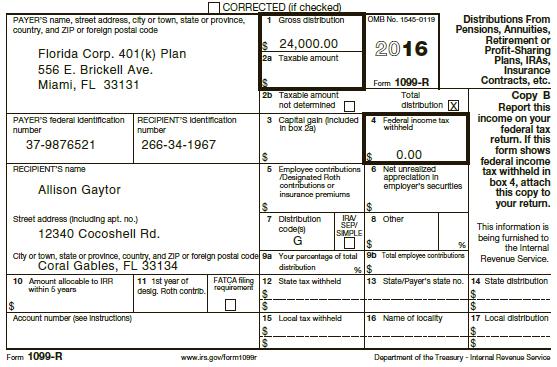

For the 2016 tax year, on March 15, 2017, Albert contributes $5,500 to a traditional IRA for himself and $5,500 to a traditional IRA for his wife. He is not covered by a qualified retirement plan at work. Allison had a retirement plan at the job from which she was laid off on January 2, 2016. The plan had a balance of $24,000. Allison received the following Form 1099-R in 2016:

Required: Combine this new information about the Gaytor family with the information from Chapters 1–3 and complete a revised 2016 tax return for Albert and Allison. Be sure to save your data input files since this case will be expanded with more tax information in later chapters. Note that the “Saver’s Credit” discussed in LO 4.8 may apply.

Step by Step Answer:

Income Tax Fundamentals 2017

ISBN: 9781305872738

35th Edition

Authors: Gerald E. Whittenburg, Steven Gill, Martha Altus Buller