Tsate Kongia (birthdate 02/14/1954) is an unmarried high school principal. Tsate received the following tax documents: During

Question:

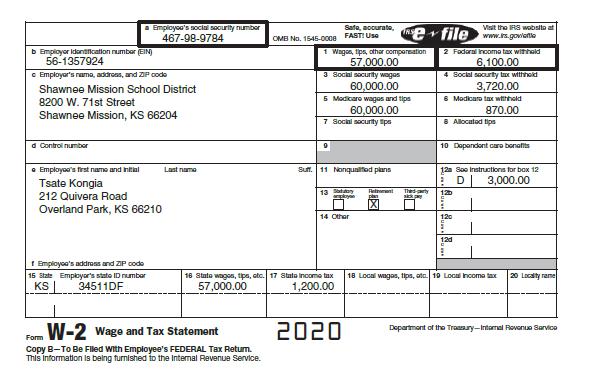

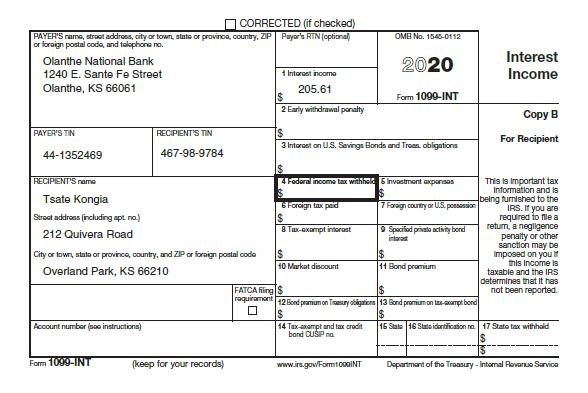

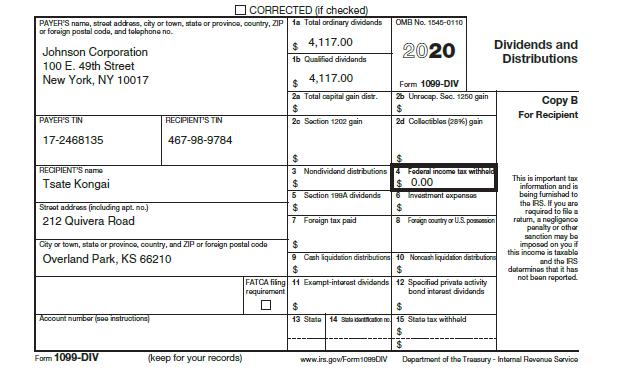

Tsate Kongia (birthdate 02/14/1954) is an unmarried high school principal. Tsate received the following tax documents:

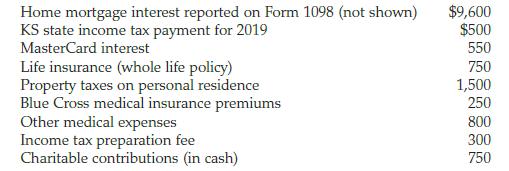

During the year, Tsate paid the following amounts (all of which can be substantiated):

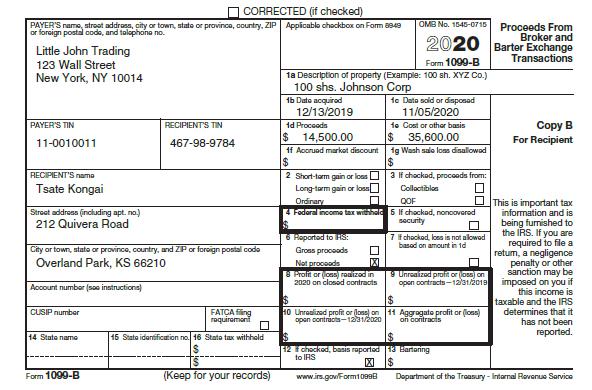

Tsate’s sole stock transaction was reported on a Form 1099-B:

On January 28, 2020, Tsate sold land for $180,000 (basis to Tsate of $130,000). The land was purchased 6 years ago as an investment. Tsate received $50,000 as a down payment and the buyer’s 10-year note for $130,000. The note is payable at the rate of $13,000 per year plus 8 percent interest. On December 31, 2020, the first of the ten principal and interest payments was received by Tsate.

Tsate also helps support his father, Jay Hawke, who lives in a nearby senior facility. Jay’s Social Security number is 433-33-2121. Tsate provides over one-half of Jay’s support but Jay also has a pension that paid him income of $14,000 in 2020. His Social Security benefits were $3,200 in 2020. Tsate received a $1,200 EIP in 2020.

Required:

Complete Tsate’s federal tax return for 2020. Use Form 1040-SR, Schedule A, Schedule B, Schedule D, Form 8949, the Qualified Dividends and Capital Gain Tax Worksheet, and Form 6252, as needed, to complete this tax return. Make realistic assumptions about any missing data.

Step by Step Answer:

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill