Using the information from Problem 11, complete Form 941 and Worksheet 1 located on Pages 9-55 to

Question:

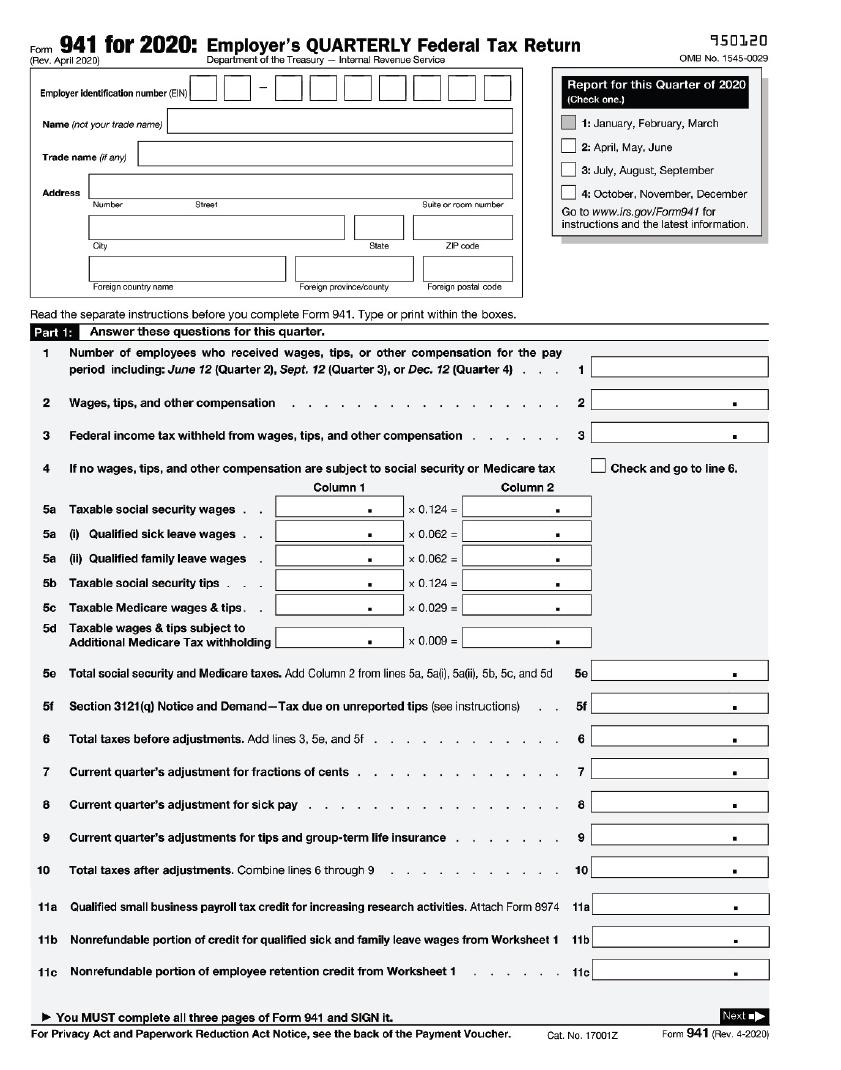

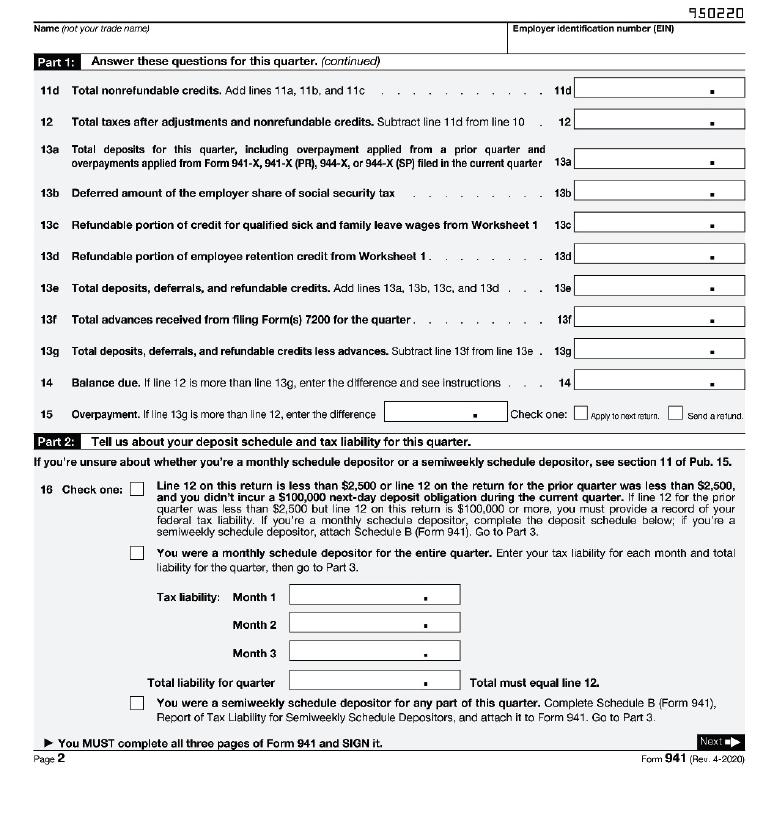

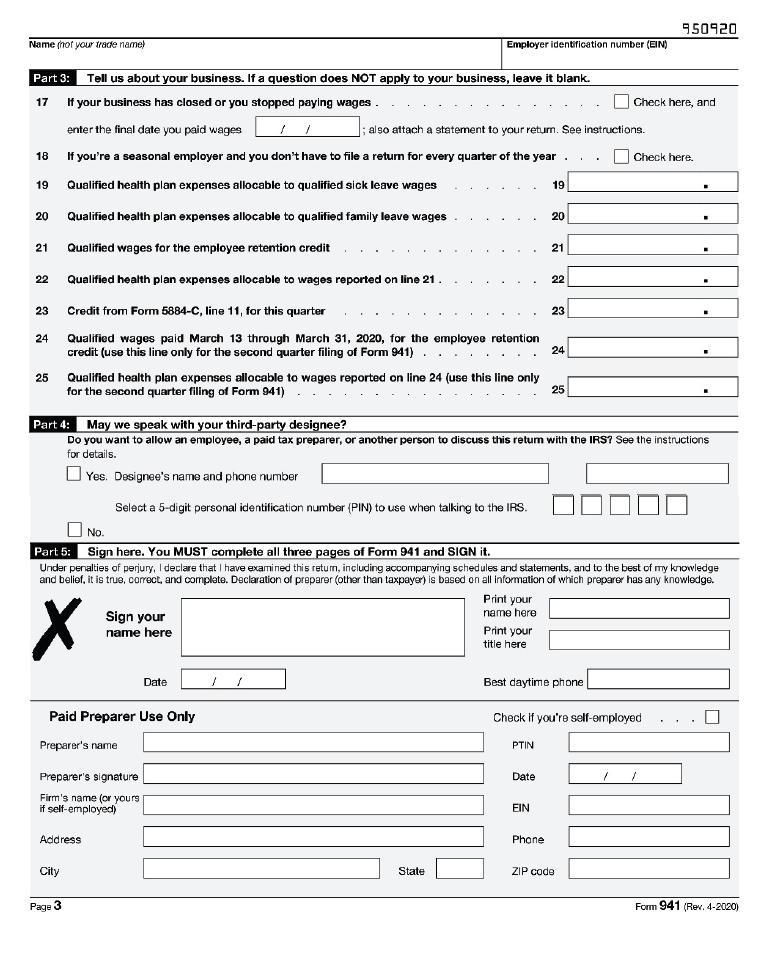

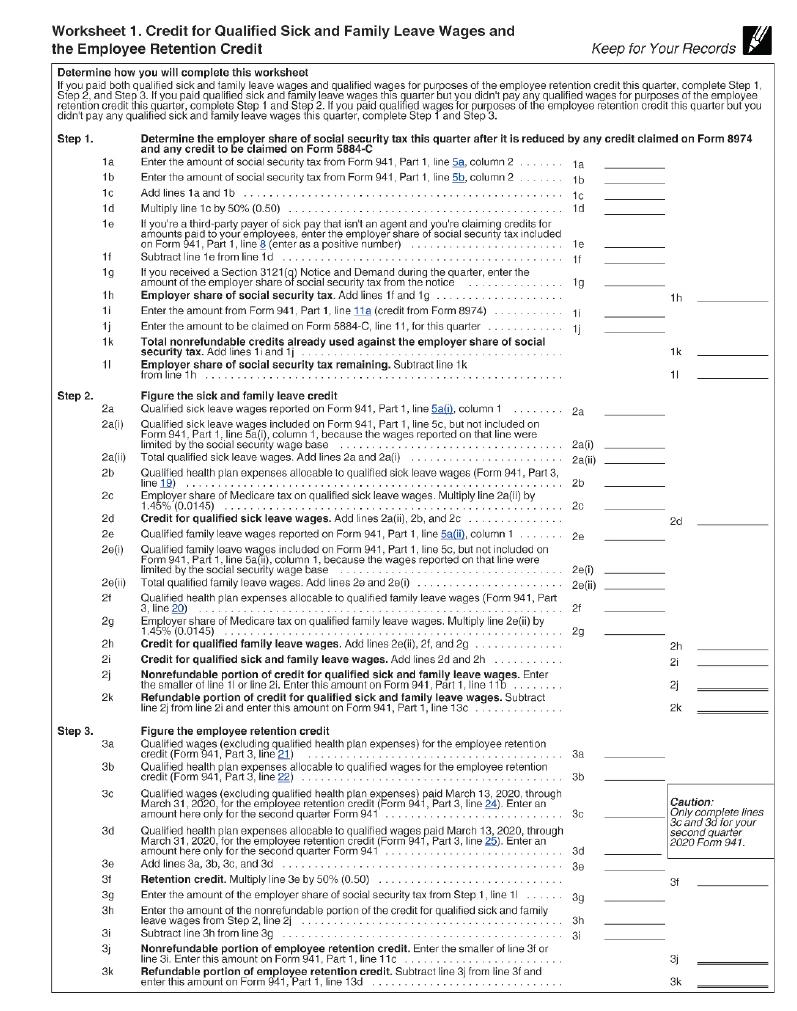

Using the information from Problem 11, complete Form 941 and Worksheet 1 located on Pages 9-55 to 9-58 for Drew for the second quarter of 2020.

Assume the following additional information:

• Drew was eligible for the employee retention credit.

• All of Jack’s wages are for two weeks of sick pay. He was not paid for any other time in the second quarter.

• All of Avery’s wages cover 10 weeks of family leave. She was paid for no other time in the second quarter.

• The allocation of health care costs is $600 for the quarter for each employee.

Transcribed Image Text:

Form 941 for 2020: Employer's QUARTERLY Federal Tax Return (Rev. April 2020) Department of the Treasury - Internal Revenue Service Employer identification number (EIN) Name (not your trade name) Trade name (if any) Address 2 3 5f Foreign province/county Read the separate instructions before you complete Form 941. Type or print within the boxes. Part 1: Answer these questions for this quarter. 1 Number 7 City 8 9 Street Foreign country name Number of employees who received wages, tips, or other compensation for the pay period including: June 12 (Quarter 2), Sept. 12 (Quarter 3), or Dec. 12 (Quarter 4) Wages, tips, and other compensation Federal income tax withheld from wages, tips, and other compensation 4 If no wages, tips, and other compensation are subject to social security or Medicare tax Column 1 Column 2 6 Total taxes before adjustments. Add lines 3, 5e, and 5f 10 State 5a Taxable social security wages .. 5a (i) Qualified sick leave wages. 5a (1) Qualified family leave wages. 5b Taxable social security tips. 5c Taxable Medicare wages & tips. Taxable wages & tips subject to Additional Medicare Tax withholding 5d 5e Total social security and Medicare taxes. Add Column 2 from lines 5a, 5a(i), 5a(ii), 5b, 5c, and 5d Section 3121(q) Notice and Demand-Tax due on unreported tips (see instructions) Current quarter's adjustment for fractions of cents Current quarter's adjustment for sick pay.. . . Suite or room number . ZIP code . Foreign postal code Total taxes after adjustments. Combine lines 6 through 9 x 0.124 = x 0.062 = x 0.062 = x 0.124 = x 0.029 = x 0.009 = Current quarter's adjustments for tips and group-term life insurance . .. You MUST complete all three pages of Form 941 and SIGN it. For Privacy Act and Paperwork Reduction Act Notice, see the back of the Payment Voucher. Report for this Quarter of 2020 (Check one.) 1: January, February, March 2: April, May, June 3: July, August, September 4: October, November, December Go to www.irs.gov/Form941 for instructions and the latest information. . . . . . ... 1 2 3 5e 5f 6 7 8 9 10 11a Qualified small business payroll tax credit for increasing research activities. Attach Form 8974 11a 11b 11b Nonrefundable portion of credit for qualified sick and family leave wages from Worksheet 1 11c Nonrefundable portion of employee retention credit from Worksheet 1 11c 950120 OMB No. 1545-0029 Check and go to line 6. Cat. No. 17001Z . . . Next Form 941 (Rev. 4-2020)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

See Form 941 Name not your trade name Drew Fogelman Part 1 Answer these questions for this quarter continued 11d Total nonrefundable credits Add lines ...View the full answer

Answered By

Muhammad Ahtsham Shabbir

I am a professional freelance writer with more than 7 years’ experience in academic writing. I have a Bachelor`s Degree in Commerce and Master's Degree in Computer Science. I can provide my services in various subjects.

I have professional excellent skills in Microsoft ® Office packages such as Microsoft ® Word, Microsoft ® Excel, and Microsoft ® PowerPoint. Moreover, I have excellent research skills and outstanding analytical and critical thinking skills; a combination that I apply in every paper I handle.

I am conversant with the various citation styles, among them; APA, MLA, Chicago, Havard, and AMA. I also strive to deliver the best to my clients and in a timely manner.My work is always 100% original. I honestly understand the concern of plagiarism and its consequences. As such, I ensure that I check the assignment for any plagiarism before submission.

4.80+

392+ Reviews

587+ Question Solved

Related Book For

Income Tax Fundamentals 2021

ISBN: 9780357141366

39th Edition

Authors: Gerald E. Whittenburg, Martha Altus-Buller, Steven Gill

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Using the information from Problem 19-4, prepare the three financial statements illustrated in the chapter for federal agencies: In Problem 19-4, Following is the September 30, 20X8, trial balance...

-

Consider the 70 households that purchased a DVD player, 48 households are satisfied with their purchase and 22 households are dissatisfied. Suppose two households are randomly selected from the...

-

In the GS Petroleum case earlier in this chapter, what should the signature line have looked like?

-

Identify whether each of the following items should be classified in cash and cash equivalents or some other category' in the balance sheet. Assume that the reporting entity has operations in Canada....

-

At the horse races one Saturday afternoon Gavin Jones studies the racing form and concludes that the horse No Arbitrage has a $25 %$ chance to win and is posted at 4 to 1 odds. (For every dollar...

-

Antikron Company produces rubber seals used in the aerospace industry. Standards call for 4 pounds of material at $3.50 per pound for each seal. The standard cost for labor is .6 hours at $21 per...

-

Information on the various budget activities appears below. The budget month is January of the current year and on that date you had a budget of $32.50. 1. You receive a check from a family member as...

-

Eric, your friend, received his Form W-2 from his employer (below) and has asked for your help. Erics 2020 salary was $146,000 and he does not understand why the amounts in Boxes 1, 3, and 5 are not...

-

Abbe, age 56, started a new job in 2020. At Abbes previous employer she had filed a Form W-4 with 5 allowances. Abbes new employer will: a. Use a copy of Abbes previous Form W-4 to calculate income...

-

Find experience for EX and Vax X if X is a random variables with the general discrete uniform(N0, N1) distribution that puts equal probability in each of the values N0, N0 + 1, . . . . . . . . . .,...

-

Name six types of managerial behaviors that can reduce a firms intrinsic value.

-

How do stock splits and dividends affect stock prices?

-

Why is the after-tax cost of debt, rather than its before-tax required rate of return, used to calculate the weighted average cost of capital?

-

What are stock splits and stock dividends?

-

Describe the decision process for distribution policy and dividend payout. Be sure to discuss all the factors that influence this decision.

-

Ray Corporation, a small manufacturing firm, wants to establish a pension fund for its 10 employees who range from 28 to 51 years of age. Ray wants each employee who retires from the firm at age 65...

-

Factor and simplify, if possible. Check your result using a graphing calculator. 3 cot 2 + 6 cot + 3

-

Gina receives a $3,000 distribution from her educational savings account. She uses $1,600 to pay for qualified higher education expenses and $1,400 on a vacation. Immediately prior to the...

-

Which of the following is correct for Qualified Tuition Programs? a. Contributions are deductible, and qualified educational expense distributions are tax free. b. Contributions are not deductible,...

-

In 2016, Amy receives $8,000 (of which $3,000 is earnings) from a qualified tuition program. She does not use the funds to pay for tuition or other qualified higher education expenses. What amount is...

-

how to relate "The advisor" and "The Nurture" sparktype personalities in communication and leadership in healthcare?

-

How can the integration of game theory and behavioral economics enhance strategic decision-making by providing insights into competitors' likely actions, strategic interdependencies, and cognitive...

-

Evaluate personal and written communications and develop an individual plan to improve. Personal Communication: 1. How is my tone when I speak to people? 2. Do I have good eye contact? Is my eye...

Study smarter with the SolutionInn App