Question: Follow the step-by-step procedures provided to complete this problem for Copier Solutions for the month of April of the current year. Display your reports as

Follow the step-by-step procedures provided to complete this problem for Copier Solutions for the month of April of the current year. Display your reports as necessary to answer the questions.

Step 1: Start Integrated Accounting 8e.

Step 2: Load opening balances file IA8 Problem 05-A.

Step 3: Enter your name in the Your Name text box and click OK.

Step 4: Save the file with a file name of 05-A Your name.

Step 5: Enter the following budget amount changes resulting from an anticipated increase in sales projected by management.

Budget Changes

Account Title Budget

Total Revenue ................................................$585,000.00

Cost of Merchandise Sold ............................$345,000.00

Advertising Expense .........................................$4,250.00

Salaries Expense .............................................$55,000.00

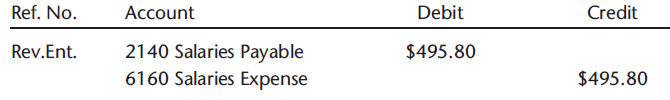

Step 6: Enter the following salaries reversing general journal transaction.

Salaries Reversing General Journal Transaction

Apr. 01

Using the adjustment data presented in Sample Problem 05-S as the basis for your reversing entries, the only entry that requires reversing is for salaries payable as shown below.

Reversing Entries €“ Reversing entries are general journal entries made on the first day of a new accounting period that are the exact reverse of an adjusting entry made at the end of the previous period.

In this reversing entry, $495.80 of salaries from the previous accounting period applies to this accounting period.

Step 7: Enter the following purchase order, purchase invoice, and sales invoice transactions:

Purchase Order, Purchase Invoice, and Sales Invoice Transactions

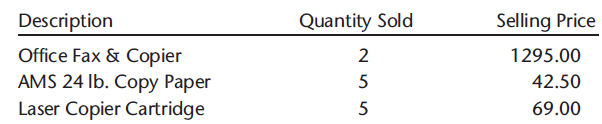

Apr. 02

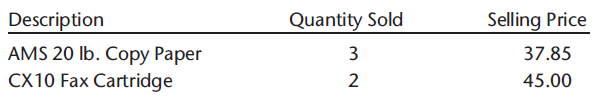

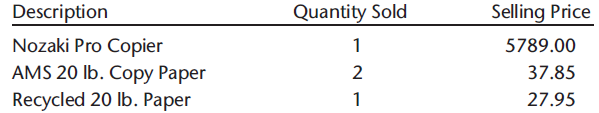

Sold the following merchandise to Malott Realty Co.; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 733:

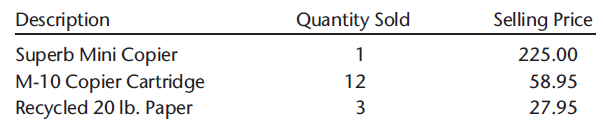

05

Sold the following merchandise to Morgan Home Center; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 734:

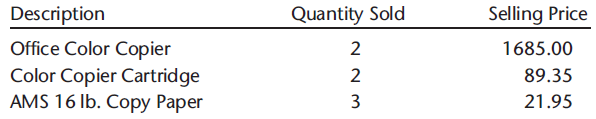

08

Sold the following merchandise to Carol€™s Office Products; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 735:

10

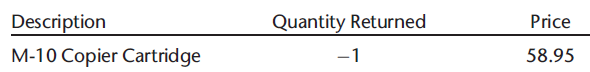

The following merchandise was returned by J & M Construction Co., 7% sales tax, Sales Return No. R725:

13

Sold the following merchandise to Baer Insurance Agency; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 736:

15

Ordered the following merchandise from Tokuda Corporation; terms 2/10, n/30. Purchase Order No. 269.

18

Sold the following merchandise to Siegel Mortgage Co.; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 737:

20

Sold the following merchandise to J & M Construction Co.; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 738:

21

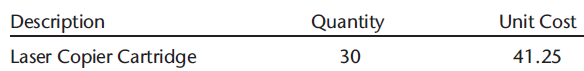

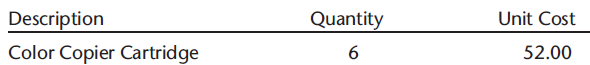

Received the following merchandise for Purchase Order No. 266 from Cody Industries, Inc., terms 2/10, n/30. Purchase Invoice No. 428.

23

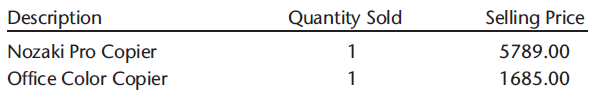

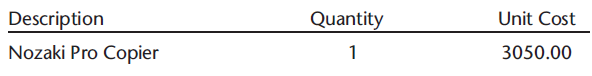

Received the following merchandise for Purchase Order No. 268 from Nozaki Corporation, terms 2/10, n/30. Purchase Invoice No. 429.

28

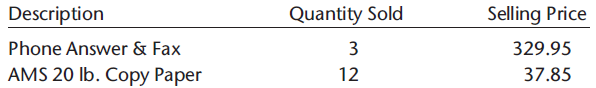

Sold the following merchandise to Klein & Associates; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 739:

30

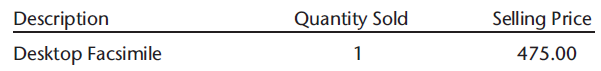

Sold the following merchandise to Florence Carpets; terms 2/10, n/30; 7% sales tax; Sales Invoice No. 740:

Step 8: Enter the following cash payment and cash receipt transactions:

Cash Payment and Cash Receipt Transactions

Apr. 01

Received cash on account from Tasler Corporation, covering Sales Invoice No. 726 for $6,194.23, less 2% discount, $123.88.

03

Received cash for the maturity value of Note Receivable, $3,417.00; principal, $3,350.00, plus interest, $67.00. Cash Receipt No. 27.

05

Paid cash for insurance premium, $515.00. Check No. 8449.

07

Paid cash for supplies, $476.00. Check No. 8450.

10

Received cash on account from Florence Carpets, covering Sales Invoice No. 731 for $1,587.05, less 2% discount, $31.74.

15

Paid monthly rent, $1,250.00. Check No. 8451.

17

Received cash on account from Morgan Home Center, covering Sales Invoice No. 716 for $1,678.79, less 2% discount, $33.58.

19

Paid monthly heating and lighting bill, $357.65. Check No. 8452.

21

Paid cash for advertising, $120.00. Check No. 8453

22

Paid cash for miscellaneous expense, $35.00. Check No. 8454.

25

Paid monthly telephone bill, $498.58. Check No. 8455.

27

Paid invoice 418 to REM Paper Company, $1,050.00, less 2% discount, $21.00. Check no. 8456.

29

Received cash on account from Siegel Mortgage Co., covering Sales Invoice No. 732 for $7,151.35, less 2% discount, $143.03.

30

Paid sales tax liability, $2,501.72. Check No. 8457.

30

Paid salaries expense, $3,294.82. Check No. 8458.

Step 9: Display the purchase order, purchase invoices, and sales invoice registers for the month of April.

Step 10: Display the general, purchases, cash payments, sales, and cash receipts journals for the month of April.

Step 11: Display the Schedule of Accounts Payable and Accounts Payable Ledger reports.

Step 12: Display the Schedule of Accounts Receivable and Accounts Receivable Ledger reports.

Step 13: Display a statement of account for J & M Construction Co.

Step 14: Display an Inventory List report.

Step 15: Display the inventory transactions for April.

Step 16: Display the Inventory Exceptions report.

Step 17: Display the Yearly Sales report.

Step 18: Display a trial balance.

End-of-Month Activities

After the monthly transactions have been processed, the adjusting entries must be entered into the computer and printed. The financial statements may then be displayed. The adjustment data for the month of April for Copier Solutions are listed here.

Insurance expired during April ......................................... $312.00

Inventory of supplies ...................................................... $2,137.00

Depreciation for April:

Warehouse equipment....................................................... $648.37

Office equipment................................................................ $232.00

Salaries Payable .................................................................. $439.80

Step 1: Enter the adjusting entries.

Step 2: Display the adjusting entries.

Step 3: Check your work.

Step 4: Display the income statement.

Step 5: Display the statement of owner€™s equity.

Step 6: Display the balance sheet.

Step 7: Display the budget report.

Step 8: Generate an Actual versus Budget graph.

Step 9: Use the Save menu item to save your data file.

Step 10: Use the Retirement Planner to calculate the annual contribution toward retirement using the following information:

Beginning Retirement Savings ........................ $7,500.00

Annual Yield (Percent) ................................................ 5.25

Current Age..................................................................... 25

Retirement Age............................................................... 65

Withdraw Until Age ....................................................... 85

Annual Retirement Income ........................... $75,000.00

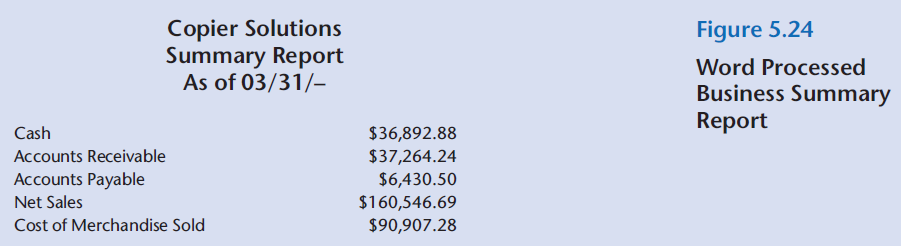

Step 11: Optional spreadsheet and word processing integration activity.

Use a spreadsheet to create a business summary report, then use a word processor to format and enhance the appearance of the report for management. The report should contain the cash balance, accounts receivable balance, accounts payable balance, net sales (sales minus sales discounts and sales returns & allowances), and cost of merchandise sold from the current trial balance.

Spreadsheet:

a. Display and copy the trial balance to the clipboard in spreadsheet format.

b. Start your spreadsheet software and load template file IA8 Spreadsheet 05-S. (If you completed the optional spreadsheet activity in Sample Problem 05-S, load your solution spreadsheet template file.)

c. Select cell A1 as the current cell, then paste the trial balance (copied to the clipboard in Step a) into the spreadsheet.

d. Enter the appropriate label(s), cell references, and formulas (see Figure 5.24).

e. Print the summary report.

f. Save the completed spreadsheet with a file name of 05-A Your Name.

Word Processing:

a. Start your word processing application software and create a new document. (Use a fixed font such as Courier.)

b. Copy and paste the spreadsheet summary report into the new document.

c. Format and enhance the report€™s appearance similar to Figure 5.24.

d. Print the report.

e. Save the document to your disk with a file name of 05-A Your Name.

f. End your spreadsheet and word processing sessions.

Step 12: End the Integrated Accounting 8e session.

Account Debit Ref. No. Credit 2140 Salaries Payable 6160 Salaries Expense Rev.Ent. $495.80 $495.80 Description Office Fax & Copier AMS 24 Ib. Copy Paper Laser Copier Cartridge Quantity Sold Selling Price 2 1295.00 42.50 69.00

Step by Step Solution

3.27 Rating (159 Votes )

There are 3 Steps involved in it

PO Number 269 Invoice Number 428 429 PO Date 0415 Invoice Date 0421 0423 Copier Solutions Purchase Order Register 0430 Vendor Name Tokuda Corporation Total Amount Copier Solutions Purchase Invoice Reg... View full answer

Get step-by-step solutions from verified subject matter experts