Question: In this problem, you will set up the accounting, fixed assets, payroll, inventory, and budgeting data for Schaff Irrigation Co. Schaff Irrigation Co. is a

In this problem, you will set up the accounting, fixed assets, payroll, inventory, and budgeting data for Schaff Irrigation Co. Schaff Irrigation Co. is a merchandising business organized as a sole proprietorship; is not departmentalized; has payroll voluntary deductions for health insurance, dental insurance, and credit union; prepares checks manually; generates the income statement by fiscal period; uses a perpetual inventory system (merchandising business with CGS account); uses the FIFO method to value its inventory; and uses a standard accounting system. The trial balance, schedule of accounts payable, schedule of accounts receivable, budget amounts, fixed assets, employees, and inventory data required to setup the opening balances as of January 1 of the current year are provided as follows:

Vendors

Alpha Irrigation Co.

C-Tech Manufacturing Inc.

Deco Electronics

Reed Irrigation Systems

Customers

Cardinal Sprinkler Inc.

Delta Irrigation

Green Landscape Co.

Maxx€™s Lawn Care

Rain Cloud Sprinkler Co.

Webb Lawn Sprinklers

Budget Amounts

Account Title....................................................................................................Budget Amount

Total Revenue................................................................................................... $620,000.00

Cost of Merchandise Sold............................................................................... $420,000.00

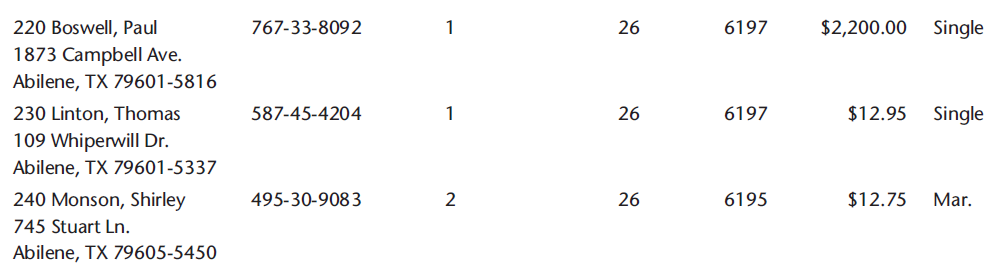

Advertising Expense............................................................................................ $2,500.00

Depr. Exp.€”Off. Eq................................................................................................. $725.00

Depr. Exp.€”Wrhs. Eq........................................................................................... $2,100.00

Insurance Expense............................................................................................... $5,250.00

Miscellaneous Expense........................................................................................ $1,000.00

Payroll Tax Expense............................................................................................ $15,000.00

Rent Expense....................................................................................................... $25,000.00

Salary Exp.€”Office.............................................................................................. $50,000.00

Salary Exp.€”Wrhs............................................................................................... $45,000.00

Telephone Expense............................................................................................... $5,000.00

Utilities Expense..................................................................................................... $7,250.00

Because the payroll system is being established on the first day of a new calendar year, it is not necessary to establish current, quarter-to-date, or year-to-date opening balances data.

Complete the following steps and answer Audit Questions 11-A on pages 500€“ 501 as you work through the problem.

Step 1: Start Integrated Accounting 8e.

Step 2: Use the New command from the File menu to prepare the computer for setup.

Step 3: Enter your name in the Your Name text box.

Step 4: Enter information into the data fields and set the check boxes and option buttons in Setup Accounting System.

Step 5: Enter the chart of accounts data.

Step 6: Enter the vendors.

Step 7: Enter the customers.

Step 8: Verify account classification and extended account classification number ranges.

Step 9: Complete the required accounts.

Step 10: Enter the account subtotals data (account number ranges) to provide the following subtotals:

Total Current Assets

Total Fixed Assets

Total Current Liabilities

Total Long-Term Liabilities

Step 11: Enter the opening balances from the general ledger account titles and balances shown at the beginning of this problem.

Step 12: Enter budget amounts.

Step 13: Display a chart of accounts, vendor list, and customer list.

Step 14: Save your data with a file name of 11-A Your Name.

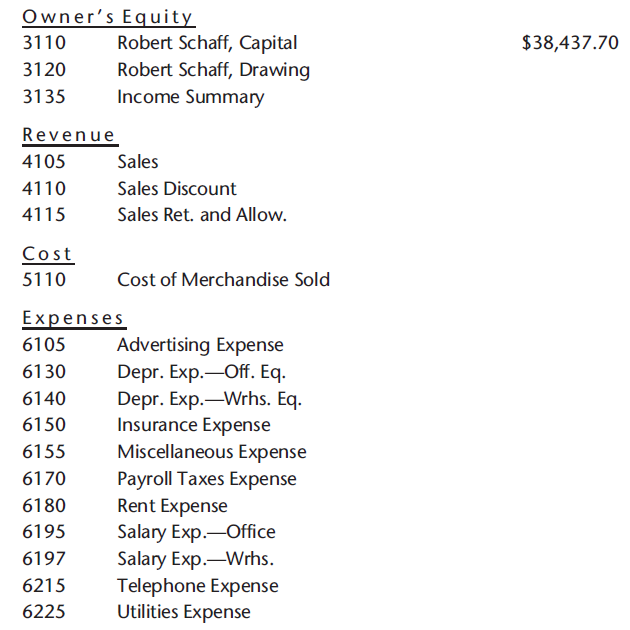

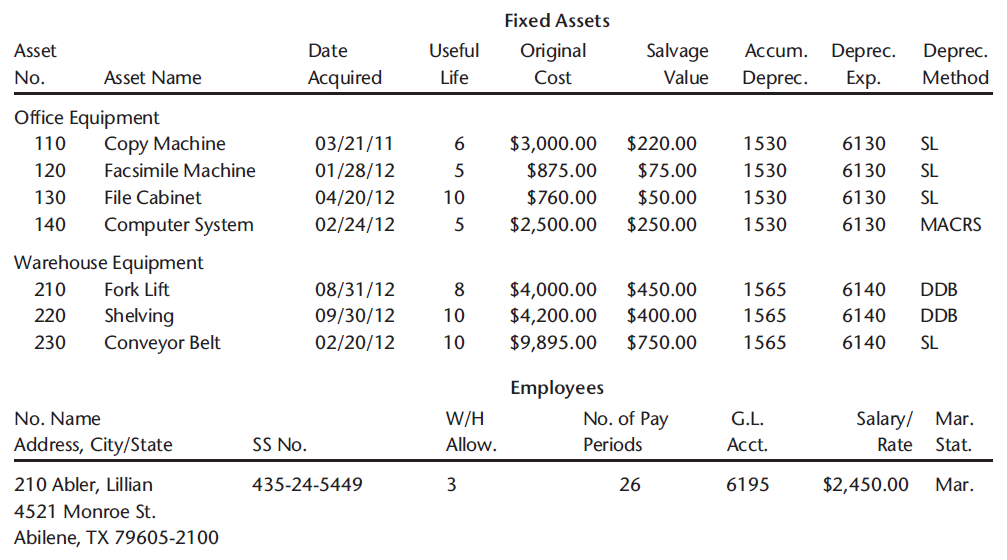

Step 15: Enter the fixed assets.

Step 16: Display the fixed assets list report.

Step 17: Save the data to your disk.

Step 18: Enter the employee data.

Step 19: Display the employee list.

Step 20: Enter a 1.5% city tax rate and .062 in the employer SS rate in the payroll tax tables.

Step 21: Save the data to your disk.

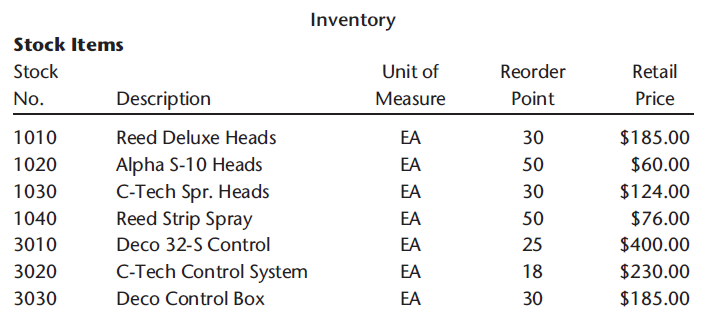

Step 22: Enter the inventory stock items.

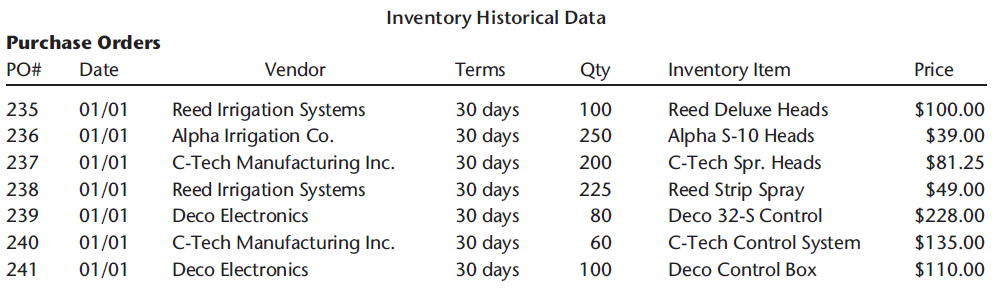

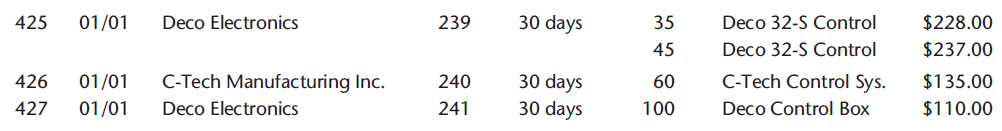

Step 23: Enter the purchase order historical data.

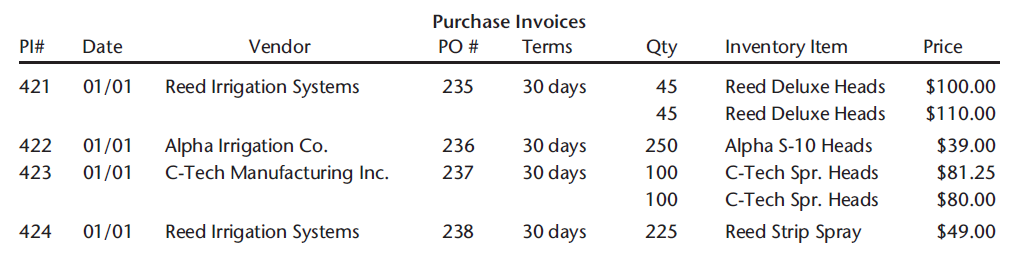

Step 24: Enter the purchase invoice historical data.

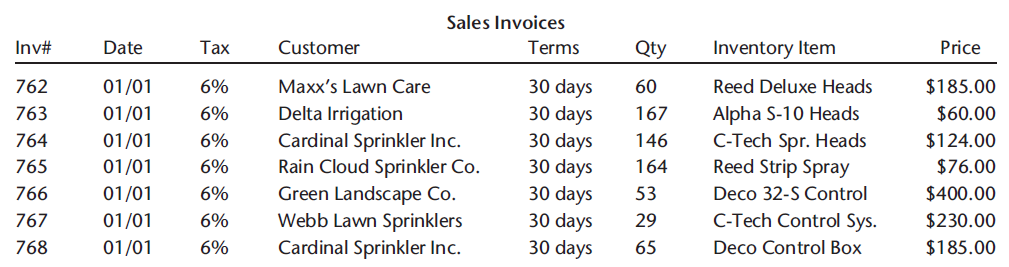

Step 25: Enter the sales invoice historical data.

Step 26: Display an inventory list report.

Step 27: Display an inventory transaction report.

Step 28: Display a trial balance, schedule of accounts payable, and schedule of accounts receivable.

Step 29: Save your data to disk.

Step 30: End the Integrated Accounting 8e session.

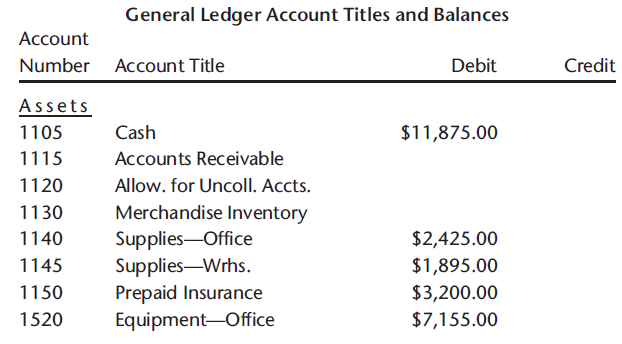

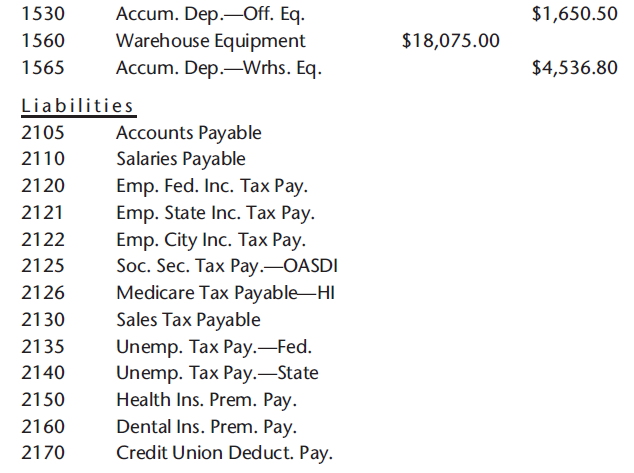

General Ledger Account Titles and Balances Account Credit Number Account Title Debit Assets Cash 1105 $11,875.00 1115 Accounts Receivable 1120 Allow. for Uncoll. Accts. Merchandise Inventory 1130 Supplies-Office Supplies-Wrhs. Prepaid Insurance Equipment-Office 1140 $2,425.00 1145 $1,895.00 $3,200.00 1150 1520 $7,155.00 Accum. Dep.-Off. Eq. Warehouse Equipment Accum. Dep.-Wrhs. Eq. 1530 $1,650.50 1560 $18,075.00 1565 $4,536.80 Liabilities Accounts Payable Salaries Payable Emp. Fed. Inc. Tax Pay. Emp. State Inc. Tax Pay. Emp. City Inc. Tax Pay. Soc. Sec. Tax Pay.-OASDI Medicare Tax Payable-HI Sales Tax Payable Unemp. Tax Pay.-Fed. Unemp. Tax Pay.-State Health Ins. Prem. Pay. 2105 2110 2120 2121 2122 2125 2126 2130 2135 2140 2150 Dental Ins. Prem. Pay. Credit Union Deduct. Pay. 2160 2170

Step by Step Solution

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Schaff Irrigation Co Chart of Accounts 0101 Assets 1105 Cash 1115 Accounts Receivable 1120 Allow for UnColl Accts 1130 Merchandise Inventory 1140 Supp... View full answer

Get step-by-step solutions from verified subject matter experts