Question: As discussed in the chapter, an important consideration in evaluating current liabilities is a companys operating cycle. The operating cycle is the average time required

As discussed in the chapter, an important consideration in evaluating current liabilities is a company’s operating cycle. The operating cycle is the average time required to go from cash to cash in generating revenue. To determine the length of the operating cycle, analysts use two measures: the average days to sell inventory (inventory-days) and the average days to collect receivables (receivable days). The inventory-days computation measures the average number of days it takes to move an item from raw materials or purchase to final sale (from the day it comes in the company’s door to the point it is converted to cash or an account receivable). The receivable-days computation measures the average number of days it takes to collect an account.

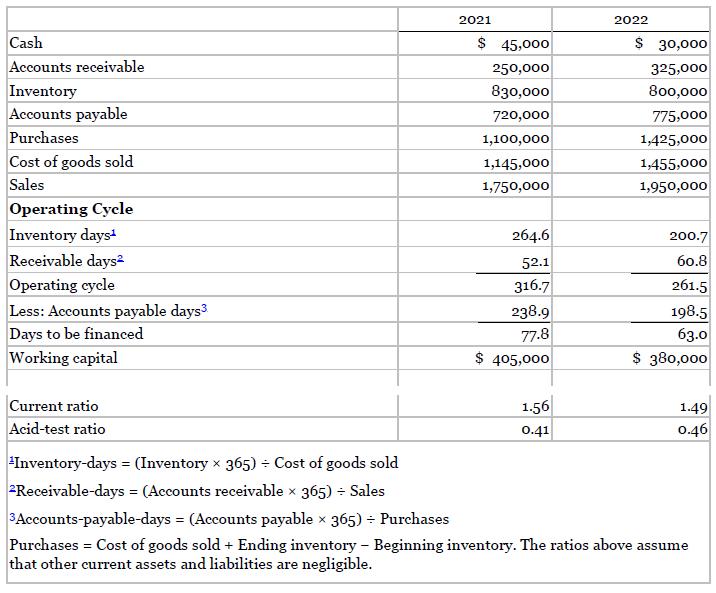

Most businesses must then determine how to finance the period of time when the liquid assets are tied up in inventory and accounts receivable. To determine how much to finance, companies first determine accounts-payable-days—how long it takes to pay creditors. Accounts-payable-days measure the number of days it takes to pay a supplier invoice. Consider the following operating cycle worksheet for BOP Clothing Co.

These data indicate that BOP has reduced its overall operating cycle (to 261.5 days) as well as the number of days to be financed with sources of funds other than accounts payable (from 78 to 63 days). Most businesses cannot finance the operating cycle with accounts payable financing alone, so working capital financing, usually short-term interest-bearing loans, is needed to cover the shortfall. In this case, BOP would need to borrow less money to finance its operating cycle in 2022 than in 2021.

Instructions

a. Use the BOP analysis to briefly discuss how the operating cycle data relate to the amount of working capital and the current and acid-test ratios.

b. Select two other real companies that are in the same industry and complete the operating cycle worksheet (similar to that prepared for BOP), along with the working capital and ratio analysis.

Briefly summarize and interpret the results. To simplify the analysis, you may use ending balances to compute turnover ratios.

2021 2022 Cash $ 45,000 $ 30,000 Accounts receivable 250,000 325,000 Inventory 830,000 800,000 Accounts payable 720,000 775,000 Purchases 1,100,000 1,425,000 Cost of goods sold 1,145,000 1,455,000 Sales 1,750,000 1,950,000 Operating Cycle Inventory days 264.6 200.7 Receivable days2 52.1 60.8 Operating cycle 316.7 261.5 Less: Accounts payable days Days to be financed 238.9 198.5 77.8 63.0 Working capital $ 405,000 $ 380,000 Current ratio 1.56 1.49 Acid-test ratio 0.41 0.46 Inventory-days = (Inventory x 365) - Cost of goods sold 2Receivable-days = (Accounts receivable x 365) - Sales 3Accounts-payable-days = (Accounts payable x 365) - Purchases Purchases = Cost of goods sold + Ending inventory - Beginning inventory. The ratios above assume that other current assets and liabilities are negligible.

Step by Step Solution

3.39 Rating (146 Votes )

There are 3 Steps involved in it

ANS WER a The analysis of the operating cycle data for B OP Clothing Co shows how c... View full answer

Get step-by-step solutions from verified subject matter experts