Financial Statement Analysis Cases Case 1 Cathay Pacifi c Airlines Cathay Pacific Airways (HKG) is an international

Question:

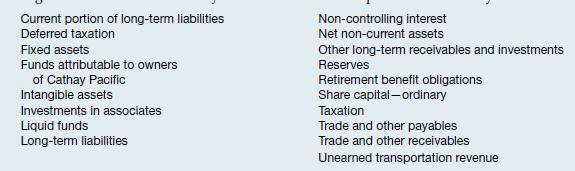

Financial Statement Analysis Cases Case 1 Cathay Pacifi c Airlines Cathay Pacific Airways (HKG) is an international airline offering scheduled passenger and cargo services to 116 destinations in 35 countries and territories. The company was founded in Hong Kong in 1946 and remains deeply committed to its home base, making substantial investments to develop Hong Kong as one of the world’s leading global transportation hubs. In addition to the fleet of 123 wide-bodied aircraft, these investments include catering, aircraft maintenance, ground-handling companies, and the corporate. The following titles were shown on Cathay’s statement of financial position in a recent year.

Instructions

(a) Organize the accounts in the general order in which they would be presented in a classified statement of financial position.

(b) When Cathay passengers purchase tickets for travel on future flights, what statement of financial position accounts are most likely affected? Do the balances in these accounts decrease or increase?

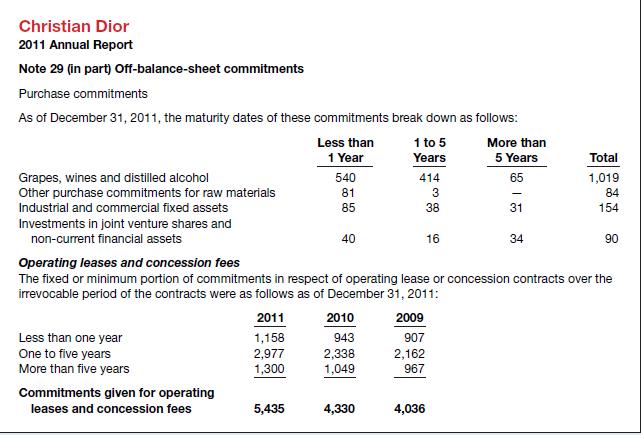

Case 2 Christian Dior Presented below is information reported by Christian Dior (FRA) related to its off-balance-sheet commitments in its 2011 annual report. Christian Dior reported current assets of €13,679 and total current liabilities of €10,256 at 31 December 2011. (All amounts are in millions of euros.)

Instructions

(a) Compute Christian Dior’s working capital and current ratio (current assets 4 current liabilities)

with and without the off-balance-sheet items reported in Note 29.

(b) Briefly discuss how the information provided in the off-balance-sheet note would be useful in evaluating Christian Dior for loans (1) due in one year, and (2) due in five years.

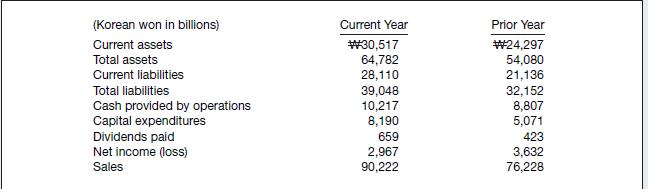

Case 3 LG Korea The incredible growth of LG Korea (KOR) has put fear into the hearts of competing appliance makers. The following financial information is taken from LG’s financial statements.

Instructions

(a) Calculate free cash flow for LG for the current and prior years, and discuss its ability to finance expansion from internally generated cash. Assume that LG’s major capital expenditures related to building manufacturing plants and that to date it has avoided purchasing large warehouses.

Instead, it has used those of others. It is possible, however, that in order to continue its growth in international sales, the company may have to build its own warehouses. If this happens, how might your impression of its ability to finance expansion change?

(b) Discuss any potential implications of the change in LG’s cash provided by operations from the prior year to the current year.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield