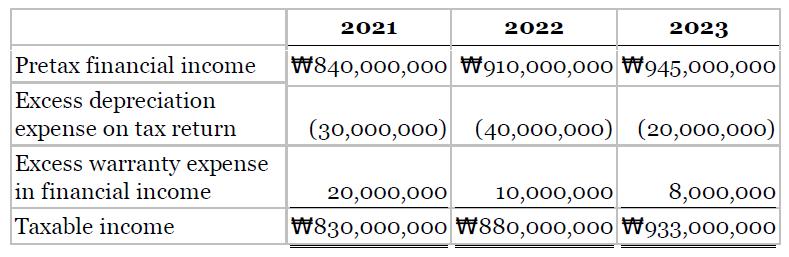

Jeonbuk Ltd. has two temporary differences between its income tax expense and income taxes payable. The information

Question:

Jeonbuk Ltd. has two temporary differences between its income tax expense and income taxes payable. The information is shown below.

The income tax rate for all years is 40%.

Instructions

a. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2021, 2022, and 2023.

b. Assuming there were no temporary differences prior to 2021, indicate how deferred taxes will be reported on the 2023 statement of financial position. Jeonbuk’s product warranty is for 12 months.

c. Prepare the income tax expense section of the income statement for 2023, beginning with the line “Pretax financial income.”

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: