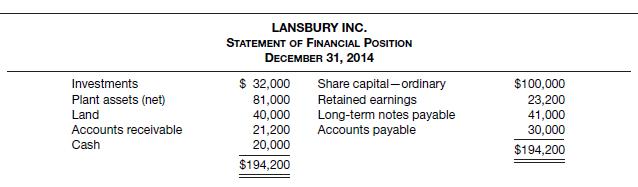

Lansbury Inc. had the statement of financial position shown below at December 31, 2014. During 2015, the

Question:

Lansbury Inc.

had the statement of financial position shown below at December 31, 2014.

During 2015, the following occurred.

1. Lansbury Inc. sold part of its investment portfolio for $15,000. This transaction resulted in a gain of $3,400 for the firm. The company classifies its investments as non-trading equity.

2. A tract of land was purchased for $18,000 cash.

3. Long-term notes payable in the amount of $16,000 were retired before maturity by paying $16,000 cash.

4. An additional $20,000 in ordinary shares were issued at par.

5. Dividends totalling $8,200 were declared and paid to shareholders.

6. Net income for 2015 was $32,000 after allowing for depreciation of $11,000.

7. Land was purchased through the issuance of $30,000 in bonds.

8. At December 31, 2015, Cash was $32,000, Accounts Receivable was $41,600, and Accounts Payable remained at $30,000.

Instructions

(a) Prepare a statement of cash flows for 2015.

(b) Prepare a statement of financial position as it would appear at December 31, 2015.

(c) How might the statement of cash flows help the user of the financial statements? Compute free cash flow and two cash flow ratios.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield