On July 1, 2022, Brandon SE purchased Mills Company by paying 250,000 cash and issuing a 150,000

Question:

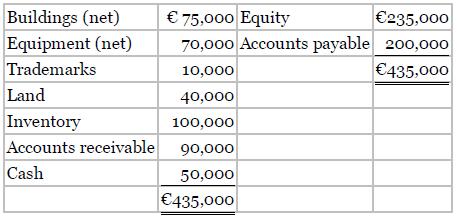

On July 1, 2022, Brandon SE purchased Mills Company by paying €250,000 cash and issuing a €150,000 note payable. At July 1, 2022, the statement of financial position of Mills Company was as follows.

The recorded amounts all approximate current values except for land (fair value of €80,000), inventory (fair value of €125,000), and trademarks (fair value of €15,000).

Instructions

a. Prepare the July 1 entry for Brandon to record the purchase.

b. Prepare the December 31 entry for Brandon to record amortization of intangibles. The trademarks have an estimated useful life of 4 years with a residual value of €3,000.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: