Ramirez Co. decides at the beginning of 2015 to adopt the FIFO method of inventory valuation. Ramirez

Question:

Ramirez Co. decides at the beginning of 2015 to adopt the FIFO method of inventory valuation. Ramirez had used the average-cost method for financial reporting since its inception on January 1, 2013, and had maintained records adequate to apply the FIFO method retrospectively.

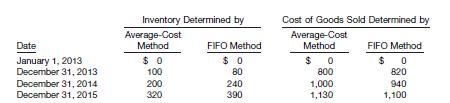

Ramirez concluded that FIFO is the preferable inventory method because it reflects the current cost of inventory on the statement of financial position. The following table presents the effects of the change in accounting policy on inventory and cost of goods sold.

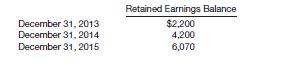

Retained earnings reported under average-cost are as follows.

Other information:

1. For each year presented, sales are $4,000 and operating expenses are $1,000.

2. Ramirez provides two years of financial statements. Earnings per share information is not required.

Instructions

(a) Prepare income statements under average-cost and FIFO for 2013, 2014, and 2015.

(b) Prepare income statements reflecting the retrospective application of the accounting change from the average-cost method to the FIFO method for 2015 and 2014.

(c) Prepare the note to the financial statements describing the change in method of inventory valuation.

In the note, indicate the income statement line items for 2015 and 2014 that were affected by the change in accounting policy.

(d) Prepare comparative retained earnings statements for 2014 and 2015 under FIFO.

Step by Step Answer:

Intermediate Accounting IFRS Edition

ISBN: 9781118443965

2nd Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield