The accounting staff of Holder Inc. has prepared the following postretirement benefit worksheet (amounts in ). Unfortunately,

Question:

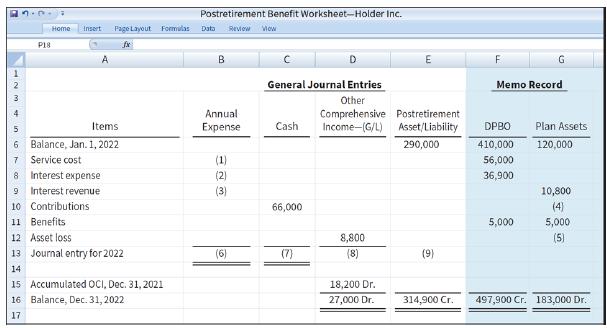

The accounting staff of Holder Inc. has prepared the following postretirement benefit worksheet (amounts in €). Unfortunately, several entries in the worksheet are not decipherable. The company has asked your assistance in completing the worksheet and completing the accounting tasks related to the pension plan for 2022.

Instructions

a. Determine the missing amounts in the 2022 postretirement worksheet, indicating whether the amounts are debits or credits.

b. Prepare the journal entry to record 2022 postretirement expense for Holder Inc.

c. What discount rate is Holder using in accounting for the interest on its other postretirement benefit plan? Explain.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield