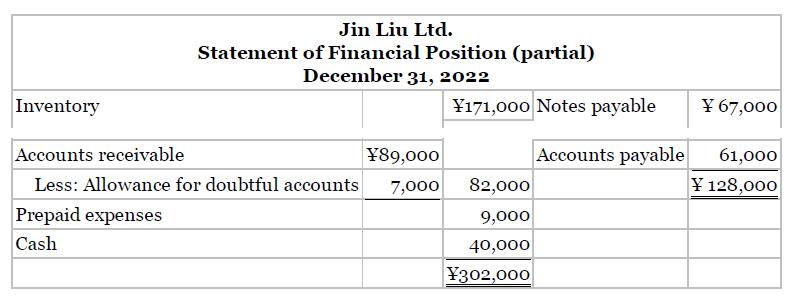

The current assets and current liabilities sections of the statement of financial position of Jin Liu Ltd.

Question:

The current assets and current liabilities sections of the statement of financial position of Jin Liu Ltd. appear as follows (amounts in thousands).

The following errors in the company’s accounting have been discovered:

1. January 2023 cash disbursements entered as of December 2022 included payments of accounts payable in the amount of ¥35,000, on which a cash discount of 2% was taken.

2. The inventory included ¥27,000 of merchandise that had been received at December 31 but for which no purchase invoices had been received or entered. Of this amount, ¥10,000 had been received on consignment; the remainder was purchased f.o.b. destination, terms 2/10, n/30.

3. Sales for the first four days in January 2023 in the amount of ¥30,000 were entered in the sales book as of December 31, 2022. Of these, ¥21,500 were sales on account and the remainder were cash sales.

4. Cash, not including cash sales, collected in January 2023 and entered as of December 31, 2022, totaled ¥35,324. Of this amount, ¥23,324 was received on account after cash discounts of 2% had been deducted; the remainder represented the proceeds of a bank loan.

Instructions

a. Restate the current assets and current liabilities sections of the statement of financial position in accordance with good accounting practice. Assume that both accounts receivable and accounts payable are recorded gross.

b. State the net effect of your adjustments on Jin Liu Ltd.’s retained earnings balance.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield