The management of Tritt Company has asked its accounting department to describe the effect upon the companys

Question:

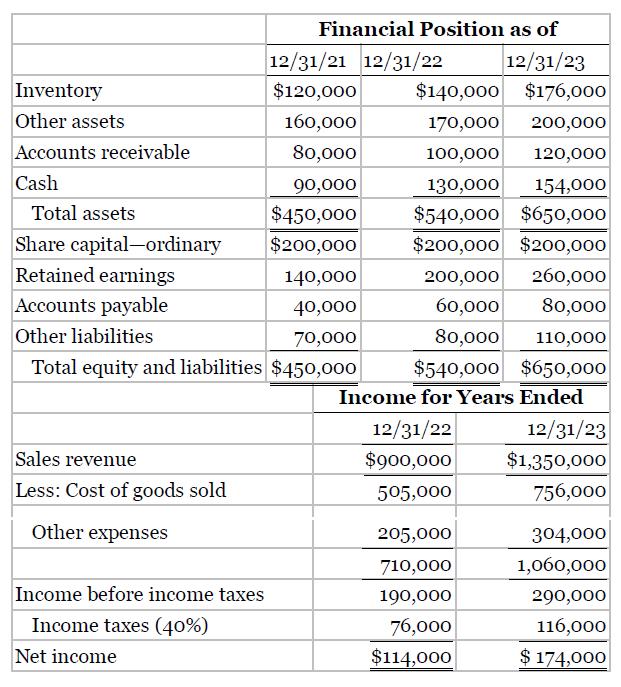

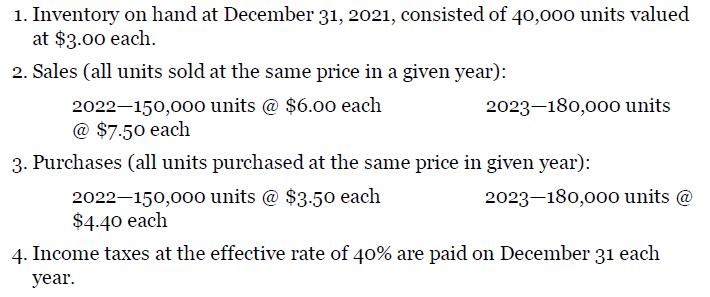

The management of Tritt Company has asked its accounting department to describe the effect upon the company’s financial position and its income statements of accounting for inventories on the LIFO rather than the FIFO basis during 2022 and 2023. The accounting department is to assume that the change to LIFO would have been effective on January 1, 2022, and that the initial LIFO base would have been the inventory value on December 31, 2021. Presented below are the company’s financial statements and other data for the years 2022 and 2023 when the FIFO method was employed.

Other data: Instructions

Instructions

Name the account(s) presented in the financial statements that would have different amounts for 2023 if LIFO rather than FIFO had been used, and state the new amount for each account that is named. Show computations.

Step by Step Answer:

Intermediate Accounting IFRS

ISBN: 9781119607519

4th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield