Question: Using the information in E20.12 about Erickson plcs defined benefit pension plan, prepare a 2022 pension worksheet with supplementary schedules of computations. Prepare the journal

Using the information in E20.12 about Erickson plc’s defined benefit pension plan, prepare a 2022 pension worksheet with supplementary schedules of computations. Prepare the journal entries at December 31, 2022, to record pension expense and related pension transactions. Also, indicate the pension amounts reported in the statement of financial position.

E20.12

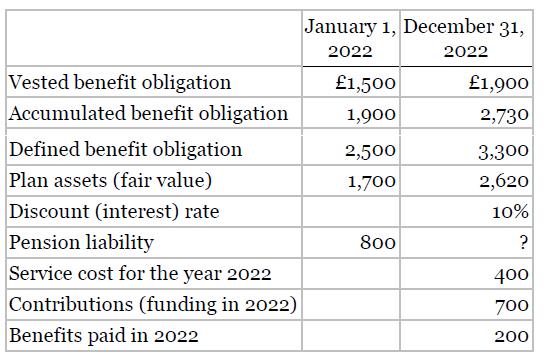

Erickson plc sponsors a defined benefit pension plan. The company’s actuary provides the following information about the plan.

January 1, December 31, 2022 2022 Vested benefit obligation 1,500 1,900 Accumulated benefit obligation 1,900 2,730 Defined benefit obligation 2,500 3,300 Plan assets (fair value) 1,700 2,620 Discount (interest) rate 10% Pension liability 800 ? Service cost for the year 2022 400 Contributions (funding in 2022) 700 Benefits paid in 2022 200

Step by Step Solution

3.37 Rating (163 Votes )

There are 3 Steps involved in it

To prepare a 2022 pension worksheet for Erickson plcs defined benefit pension plan we need to calculate and summarize the following items Service cost The cost of the benefits earned by employees duri... View full answer

Get step-by-step solutions from verified subject matter experts