Question: Using the information in E20-19, prepare a worksheet inserting January 1, 2015, balances, showing December 31, 2015, balances, and the journal entry recording postretirement benefit

Using the information in E20-19, prepare a worksheet inserting January 1, 2015, balances, showing December 31, 2015, balances, and the journal entry recording postretirement benefit expense.

Data From E20-19

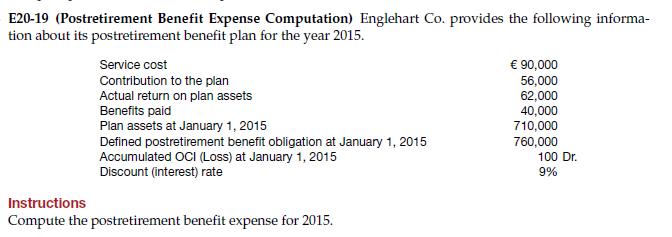

E20-19 (Postretirement Benefit Expense Computation) Englehart Co. provides the following informa- tion about its postretirement benefit plan for the year 2015. Service cost Contribution to the plan Actual return on plan assets Benefits paid Plan assets at January 1, 2015 Defined postretirement benefit obligation at January 1, 2015 Accumulated OCI (Loss) at January 1, 2015 Discount (interest) rate 90,000 56,000 62,000 40,000 710,000 760,000 100 Dr. 9% Instructions Compute the postretirement benefit expense for 2015.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts