Question: A comparative balance sheet, income statement, and additional information for the Xavier Metals Company are presented below. Additional information for Xavier: (a) All accounts receivable

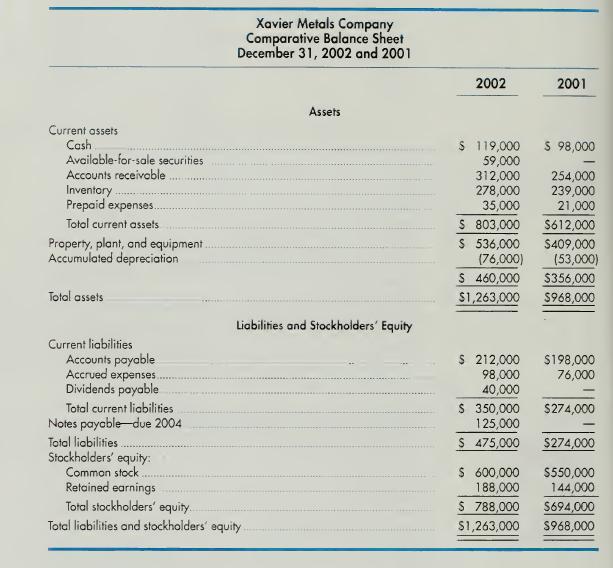

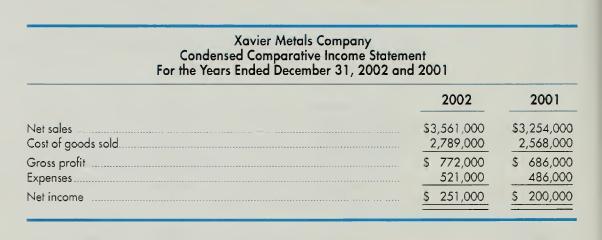

A comparative balance sheet, income statement, and additional information for the Xavier Metals Company are presented below.

Additional information for Xavier:

(a) All accounts receivable and accounts payable relate to trade merchandise.

(b) The proceeds from the notes payable were used to finance plant expansion.

(c) Capital stock was sold to provide additional working capital.

Compute the following for 2002:

1. Cash collected from accounts receivable, assuming all sales are on account.

2. Cash payments made on accounts payable to suppliers, assuming that all purchases of inventory are on account.

3. Cash payments for dividends.

4. Cash receipts that were not provided by operations.

5. Cash payments for assets that were not reflected in operations.

Current assets Cash Available-for-sale securities Accounts receivable Inventory Prepaid expenses. Total current assets Property, plant, and equipment. Accumulated depreciation Total assets Xavier Metals Company Comparative Balance Sheet December 31, 2002 and 2001 2002 2001 Assets $ 119,000 $ 98,000 59,000 Current liabilities Accounts payable Accrued expenses. Dividends payable Total current liabilities Notes payable due 2004 Total liabilities Stockholders' equity: Common stock. Retained earnings Total stockholders' equity. Liabilities and Stockholders' Equity Total liabilities and stockholders' equity 312,000 254,000 278,000 239,000 35,000 21,000 $ 803,000 $612,000 $ 536,000 $409,000 (76,000) (53,000) $ 460,000 $356,000 $1,263,000 $968,000 $ 212,000 $198,000 98,000 76,000 40,000 $ 350,000 $274,000 125,000 $ 475,000 $274,000 $ 600,000 $550,000 188,000 144,000 $ 788,000 $694,000 $1,263,000 $968,000

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts