A depreciation schedule for semi-trucks of Ichiro Manufacturing Company was requested by your auditor soon after December

Question:

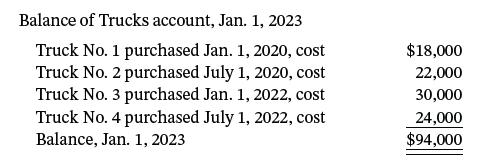

A depreciation schedule for semi-trucks of Ichiro Manufacturing Company was requested by your auditor soon after December 31, 2026, showing the additions, retirements, depreciation, and other data affecting the income of the company in the 4-year period 2023 to 2026, inclusive. The following data were ascertained.

The Accumulated Depreciation—Trucks account previously adjusted to January 1, 2023, and entered in the ledger, had a balance on that date of $30,200 (depreciation on the four trucks from the respective dates of purchase, based on a 5-year life, no salvage value). No charges had been made against the account before January 1, 2023.

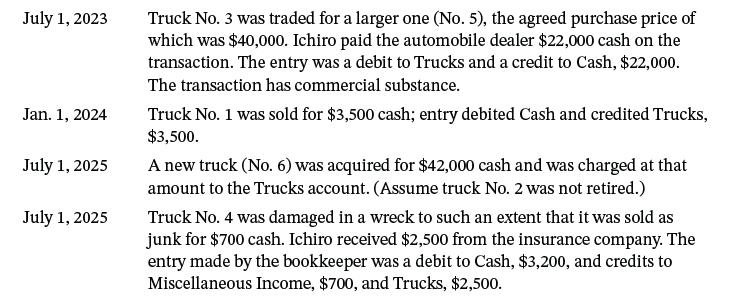

Transactions between January 1, 2023, and December 31, 2026, which were recorded in the ledger, are as follows.

Entries for straight-line depreciation had been made at the close of each year as follows: 2023, $21,000; 2024, $22,500; 2025, $25,050; and 2026, $30,400.

Instructions

a. For each of the 4 years, compute separately the increase or decrease in net income arising from the company’s errors in determining or entering depreciation or in recording transactions affecting trucks, ignoring income tax considerations.

b. Prepare one compound journal entry as of December 31, 2026, for adjustment of the Trucks account to reflect the correct balances as revealed by your schedule, assuming that the books have not been closed for 2026.

Step by Step Answer:

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield