At December 31, 2024, Belmont Company had a net deferred tax liability of $375,000. An explanation of

Question:

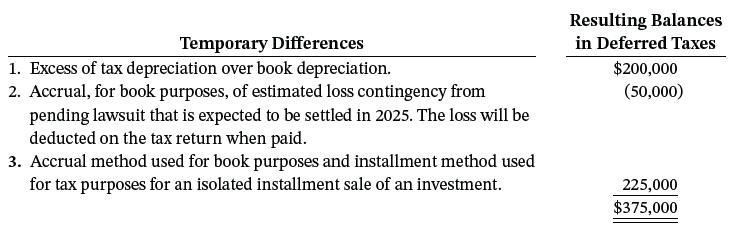

At December 31, 2024, Belmont Company had a net deferred tax liability of $375,000. An explanation of the items that compose this balance is as follows.

In analyzing the temporary differences, you find that $30,000 of the depreciation temporary difference will reverse in 2025, and $120,000 of the temporary difference due to the installment sale will reverse in 2025. The tax rate for all years is 20%.

Instructions

Indicate the manner in which deferred taxes should be presented on Belmont Company’s December 31, 2024, balance sheet.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting

ISBN: 9781119790976

18th Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield

Question Posted: