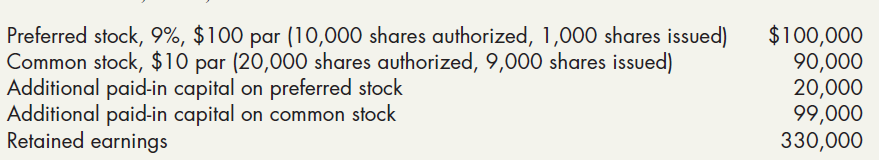

Dana Company reported the following amounts in the shareholders equity section of its December 31, 2018, balance

Question:

Dana Company reported the following amounts in the shareholders’ equity section of its

December 31, 2018, balance sheet:

During 2019, Dana’s net income was $83,000 and its dividends on preferred and common stock were $9,900 and $17,600, respectively. In addition, the following transactions affected its shareholders’ equity:

1. Purchased 750 shares of its outstanding common stock as treasury stock for $22 per share.

2. Sold 500 shares of treasury stock at $27 per share. The company uses the cost method to account for treasury stock.

3. Retired 200 of the common shares held in the treasury.

4. Issued 100 shares of preferred stock for $125 per share.

5. The aggregate market value of the company’s long-term investments in available-for-sale debt securities dropped below the carrying value of these securities at year-end. The difference between the carrying value and the year-end market value totals $10,000 (net of taxes).

Required:

1. Prepare Dana’s statement of shareholders’ equity for 2019. (Hint: This statement will include more than 10 numerical columns.) Assume Dana reports its comprehensive income in this statement.

2. Prepare the shareholders’ equity section of Dana’s balance sheet as of December 31, 2019. Include any related notes to its financial statements.

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach