Marino Company had the following balance sheet on January 1, 2019: On January 2, 2019, Paul Company

Question:

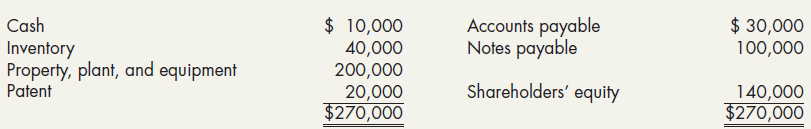

Marino Company had the following balance sheet on January 1, 2019:

On January 2, 2019, Paul Company purchased Marino by acquiring all its outstanding shares for $300,000 cash.

On that date, the fair value of the inventory was $30,000, and the fair value of the equipment was $240,000. In addition, the fair value of a previously unrecorded customer list was $25,000. For all other amounts, the book value of January 1, 2019, equaled fair value.

Required:

1. Compute the goodwill associated with the purchase of Marino.

2. Prepare the journal entry necessary at January 1, 2019, to record the acquisition of Marino.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Balance Sheet

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Question Posted: