Olson Machine Company manufactures small and large milling machines. Selling prices of these machines range from $35,000

Question:

Olson Machine Company manufactures small and large milling machines. Selling prices of these machines range from $35,000 to $200,000. During the 5-month period from August 1, 2019, through December 31, 2019, Olson manufactured a milling machine for its own use. This machine was built as part of the regular production activities. The project required a large amount of time from planning and supervisory personnel, as well as that of some of the company’s officers, because it was a more sophisticated type of machine than the regular production models.

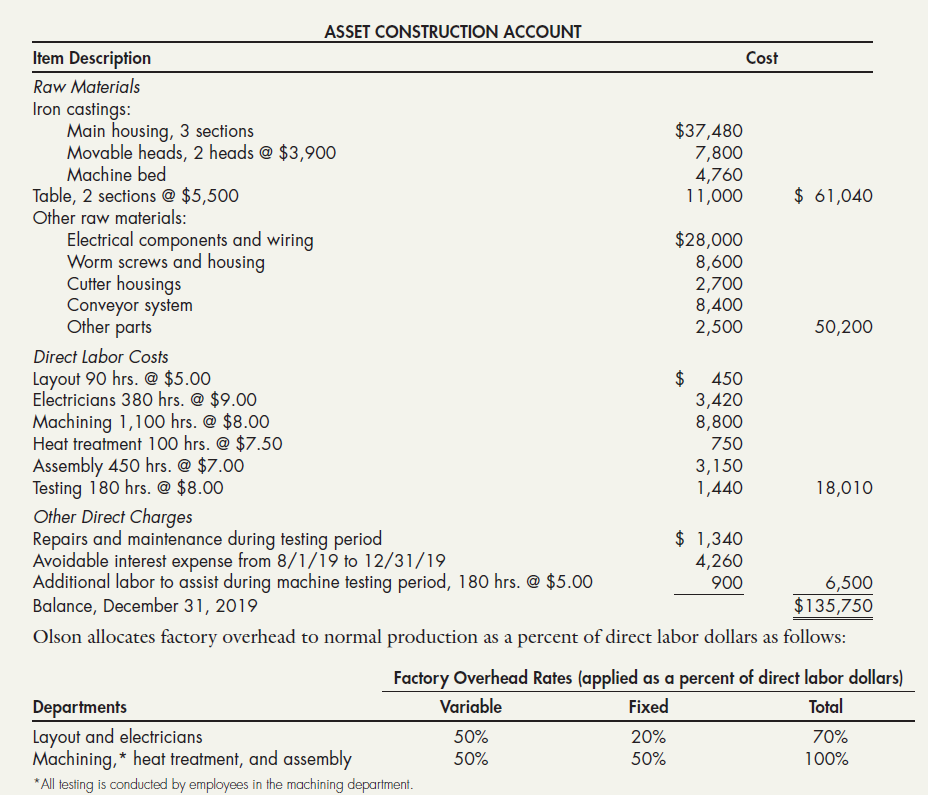

Throughout the 5-month period, Olson charged all costs directly associated with the construction of the machine to a special account entitled “Asset Construction Account.” An analysis of the charges to this account as of December 31, 2019, follows:

Olson uses a flat rate of 40% of direct labor dollars to allocate general and administrative overhead.

During the machine testing period, a cutter head malfunctioned and did extensive damage to the machine table and one cutter housing. This damage was not anticipated and was the result of an error in the assembly operation.

Although no additional raw materials were needed to make the machine operational after the accident, the following labor for rework was required:

...............................................................................Direct Labor Hours

Electric .................................................................................80

Machining ........................................................................200

Assembly .........................................................................100

Testing (conducted by machining department) ..........20

Olson has included all these labor charges in the asset construction account. In addition, it included in the account the repairs and maintenance charges of $1,340 that it incurred as a result of the malfunction.

Required:

1. Compute, consistent with GAAP and common practice, the amount that Olson should capitalize for the milling machine as of December 31, 2019, when it declares the machine operational.

2. Next Level Identify the costs you included in Requirement 1 for which there are acceptable alternative procedures. Describe the alternative procedure(s) in each case.

Generally Accepted Accounting Principles (GAAP) is the accounting standard adopted by the U.S. Securities and Exchange Commission (SEC). While the SEC previously stated that it intends to move from U.S. GAAP to the International Financial Reporting Standards (IFRS), the...

Step by Step Answer:

Intermediate Accounting Reporting and Analysis

ISBN: 978-1337788281

3rd edition

Authors: James M. Wahlen, Jefferson P. Jones, Donald Pagach