Complete the following tables by indicating whether the following events increase (I), decrease (D), or have no

Question:

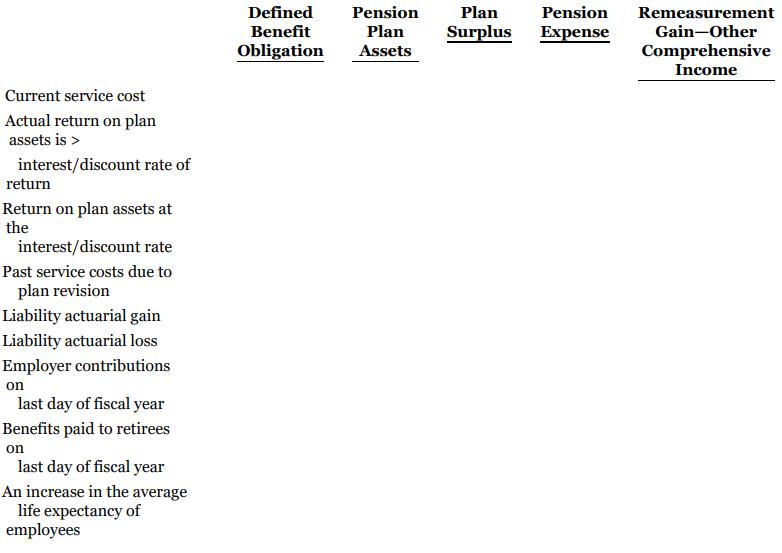

Complete the following tables by indicating whether the following events increase (I), decrease (D), or have no effect (NE) on the employer's defined benefit obligation, the pension plan assets, the pension plan's surplus, the pension expense, and the remeasurement gain—OCI. For the second item, assess only the impact of the difference between the actual return and the expected return.

a. Assume that the company applies IFRS and has a significant plan surplus and current period remeas−urement gain prior to the following events in the current year:

b. Now assume that the company uses ASPE instead of IFRS. Identify and explain what differences you would expect in the plan's situation.

Step by Step Answer:

Intermediate Accounting Volume 2

ISBN: 9781119497042

12th Canadian Edition

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Irene M. Wiecek, Bruce J. McConomy